The International Association Cedigaz has just released its hydrogen report: “The United States of America enters the global clean hydrogen race”, which assesses market developments, policies and prospects of the hydrogen industry in the United States. The report also provides data on US clean hydrogen production projects.

Although late in adopting clean hydrogen and lagging behind other major nations in defining a national strategy, the United States has prepared the groundwork for several years and is well positioned to become a global leader in clean hydrogen. The US Government is determined to lead the race in the global clean hydrogen market.

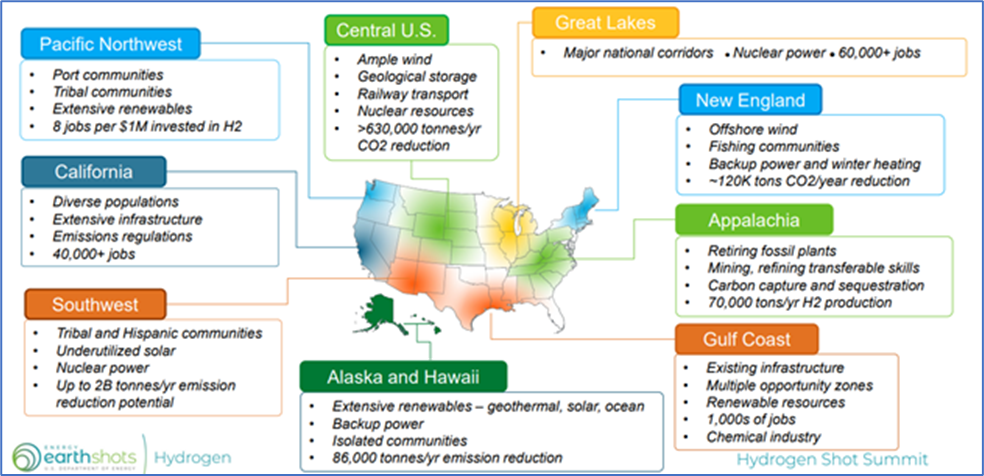

Policy support to clean hydrogen has thus been strongly reinforced. After launching the Hydrogen Shot initiative in June 2021, which aims for a significant cost reduction of clean hydrogen to propel clean hydrogen use, the government enacted into law the Bipartisan Infrastructure Bill (the BIL) on 15 November 2021. This latter lays the foundations for an ambitious national clean hydrogen strategy and already outlines the key elements of the strategy. In parallel, the Build Back Better Act (the BBB Act) was proposed to lay a more solid groundwork for social safety net and green-energy programs. On 15 February 2022, the DOE launched a request for information (RFI) on the implementation strategy of regional clean hydrogen hubs. This resulted in the proposals of numerous projects involving diverse technologies and the emergence of multi-state clean hydrogen hubs.

The US has a unique combination of natural resources to produce clean hydrogen. In addition to its huge and low-cost natural gas resources, the US has abundant sites for solar and wind, a significant nuclear power fleet and immense agricultural and forestry sectors producing waste biomass. Utilizing all forms of domestic energy and all pathways for hydrogen generation will ensure the lowest cost of production of clean hydrogen at any given time.

In a country like the US, the blue hydrogen approach is appealing, and the future of clean hydrogen is strongly intertwined with the US policy related to CCUS. To accelerate the recent momentum on CCUS, the BIL provides significant support to CCUS, investing almost $12 billion over the next five years in CCUS demonstration and infrastructure. In the clean energy and energy tax package of the BBB Act, which passed the US House of Representatives but stalled in the divided Congress, the new proposed tax credits for clean hydrogen and CCUS would significantly accelerate investment and deployment of these technologies across the US economy.

Today, the clean hydrogen market is nascent, mainly concentrated in California and the transportation sector. But clean hydrogen projects are spreading to other states and new applications. Future clean hydrogen demand is primarily driven by its use in heavy industries and the transportation sector, mainly in the heavy-duty segment, and its emerging use in the aviation and shipping sectors. Hydrogen is also emerging as a key option for emission-free and dispatchable electricity. Several US power utilities have plans to blend hydrogen in natural gas-fired power plants and transition to 100% hydrogen over the decade.

Industrial strategies are emerging centred around regional clean hydrogen hubs. In the US context, retrofitting refineries and chemical plants with CCS (blue hydrogen) provides the greatest opportunity for near-term, low-cost, and large-scale emissions reductions. Notably, leveraging existing assets in the Houston Gulf Coast area has the potential to bring substantial volumes of blue hydrogen and derivatives to new markets rapidly and at scale, enabling the emergence of a leading global clean hydrogen hub, driving lower emissions in the US and globally.

Clean hydrogen production projects are taking off. As of March 2022, there were 13 new large-scale projects involving natural gas steam methane reforming (SMR) with CCS, pyrolysis, and gasification of petcoke and biomass with CCS. If all these projects are implemented, blue and turquoise hydrogen production capacity could reach 1.8 MtH2/y in 2026 and exceed 2.8 MtH2/y in 2030. These projects mainly target the refining, chemical, and transportation sectors. Power-to-X projects (involving electrolysis of water with renewable or nuclear power) are also taking off. As of March 2022, there were 40 projects, with a combined capacity of 5.3 GW and an estimated production of 840 ktH2/y at full scale development. Most of them are expected to be completed – or have started their initial development – by end 2025.

With its unique assets to produce clean hydrogen and derivatives from an array of national energy resources, its strong technology capability and capacity to innovate, the US is well positioned to become a leading exporting country of clean hydrogen and derivatives and a global clean hydrogen leader.

Figure 1 – DOE RFI findings: Regional clean hydrogen clusters and geographic factors

Source: DOE

By Sylvie Cornot-Gandolphe for CEDIGAZ

For more information: contact@cedigaz.org

Cedigaz (International Center for Natural Gas Information) is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). Dedicated to gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, LNG, renewable gases and unconventional gas in an exhaustive and critical way.