The newly issued 2020 report on UGS by CEDIGAZ highlights the key data from the 2020 update of its global UGS database and provides a detailed analysis of 4 markets of utmost importance in balancing global gas markets now and tomorrow: Europe, Ukraine, Russia and China.

2020 UGS HIGHLIGHTS:

Europe: unprecedented high stock volumes in storage

Uncertainty about the outcome of the Russia-Ukraine negotiations after the expiry of the transit contract between Gazprom and Naftogaz at the end of 2019, strong LNG capacity additions and the Covid-19 triggered demand crunch have resulted in record filling levels of European UGSs and have led European shippers to turn to Ukraine to store their excess gas.

Ukraine: UGSs have become attractive for EU shippers

Restructuration of the Ukrainian gas market, gas interconnections with Western neighbouring countries, adoption of new storage and transportation tariffs and implementation of a set of transportation and storage incentives, have made Ukrainian UGS commercially attractive for European shippers.

Russia: sustained growth in storage deliverability

Although Gazprom is already by far the largest global storage operator it continues to develop its operations in Russia and abroad. In Russia, where it holds 75 bcm of working gas capacity, the focus is on increasing deliverability through upgrading of existing porous reservoir facilities and further development of salt caverns. Gazprom is also intent on developing new storages in regions with insufficient UGS capacities and actively pursues its development abroad, in Europe where it already holds significant working gas capacity and possibly, in China.

China: storage development has entered the fast lane

At the end of 2019, China’s UGS working gas capacity reached 14 bcm (15 UGS in 28 reservoirs), up 20% compared to the end of 2018. Despite the significant increase in 2019, UGS still represents a small share of natural gas consumption: 4.56% based on 2019 gas demand (306.7 bcm) and there is still a large room for storage expansion. Since 2018, the construction of natural gas storage infrastructure has been upgraded to a national strategy and by 2025, China is to build more than 30 UGS reservoirs and reach 32 bcm of working gas capacity.

INDEPTH ANALYSIS OF UGS IN EUROPE, UKRAINE, RUSSIA AND CHINA IN THE REPORT

KEY METRICS

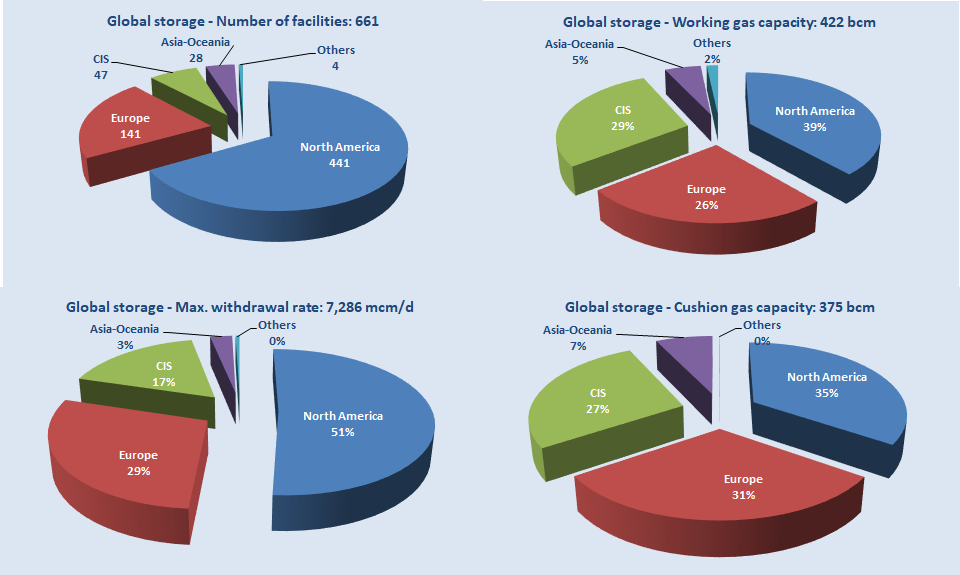

- At the end 2019, there were 661 UGS facilities in operation in the world. The global working gas capacity reached 422 billion cubic meters (bcm), up 0.9% compared to end 2018. The global peak deliverability rate amounted to 7,286 million cubic meters per day (mcm/d).

Global underground gas storage as of end 2019 – by region

- North America concentrates two thirds of the sites (441 facilities) and accounts for almost 40% of global working gas capacity (163 bcm) and more than half of global deliverability (3,726 mcm/d). There are 141 facilities in Europe (108.6 bcm, 2,082 mcm/d), 47 in the CIS (121 bcm, 1,242 mcm/d), 28 in Asia-Oceania (22.4 bcm, 200 mcm/d), and 3 in the Middle East (6.9 bcm, 34 mcm/d). There is also one small UGS in Argentina.

- Storage in depleted fields dominates with 80% of global working gas volumes, but storage in salt caverns now accounts for 26% of global deliverability.

- At the end of 2019, there were 58 storage projects under construction (new facilities and expansion of existing facilities), adding 41 bcm of working gas capacity. China alone accounts for 41% of the global capacity under construction.

- At the end of 2019, there were 97 identified projects at different stages of planning (81 planned and 16 potential projects). If all built, these projects would add 82 bcm of working gas capacity.

COMPLETE COUNTRY LEVEL DATA IN THE REPORT

Geoffroy HUREAU – CEDIGAZ

UNDERGROUND GAS STORAGE IN THE WORLD – 2020 STATUS (CEDIGAZ Insight #41 – 28 pages – PDF)