Including an analysis of the current global gas crisis – New report by CEDIGAZ

Underground gas storage is back in the spotlight with the current gas crisis, which once again illustrates its importance for security of supply, especially in Europe. The new 2021 Underground Gas Storage Report published by CEDIGAZ therefore includes an in-depth analysis of the underlying causes of the current crisis and highlights the crucial importance of storage to ensure the flexibility of the gas system. The report also provides an update of key global UGS statistics and regional dynamics at work with a focus on China and Russia.

Current gas crisis: Blame the weather and the market

European spot natural gas prices and Asian spot LNG prices reached all-time highs in October. The steep rise reflects a severe mismatch between gas supply and demand and was caused by a combination of several factors: a strong recovery in gas demand, notably in China, where coal shortages and environmental pressure reinforced the call on gas demand; unplanned LNG supply outages; extreme weather events that put immense pressure on the gas supply system, as well as on hydropower and wind generation; a sluggish recovery in gas production; and lower natural gas storage inventories in Europe.

- No quick fix

There is no quick fix to the global gas crisis because of the short-term inelasticity of winter gas demand and the lack of supply response to rising prices so far. The market should stay tight during the winter season, before falling in 2022 with higher gas production. The short-term rebalancing of gas supply and demand this winter might come from additional gas supplies, reductions in industrial gas demand and switching to alternative fuels. Norway, the US, and Russia are expected to deliver more gas to the global and European markets, although questions remain about how much more gas Gazprom would send to Europe until Nord Stream 2 is approved. On the demand side, the elevated gas prices have started to reduce demand by energy-intensive industries. Some relief could come from China where the government has taken bold measures to ensure sufficient coal generation this winter. But the wild card is the severity of the coming winter in North Asia.

- Key lessons to be drawn from the current crisis

A key lesson from the current crisis is that flexibility is essential in ensuring security and continuity of supply during the transition towards net zero emissions. In Europe, the events of 2021 are showing that the market strongly depends on midstream gas supply flexibility. Market failure (inadequate market signals) and the lack of obligation on shippers to refill their UGS make the case for storage regulation in some national markets. The new roles of UGS should be taken into account in the new European gas market design. The different values of UGS should be recognized and properly valued. Building LNG import capacities is not sufficient to increase security of supply as Europe faces global competition for spot LNG supplies. Medium/long-term contracts are still an important tool to secure gas supplies and ensure LNG (and gas) is flowing to Europe. This raises the question of the position of natural gas in the European energy mix during the transition towards net zero emissions.

READ THE COMPLETE ANALYSIS IN THE REPORT

Key UGS metrics in the world: 2020 is marked by a renewed interest in UGS

- Stagnation in global storage capacity

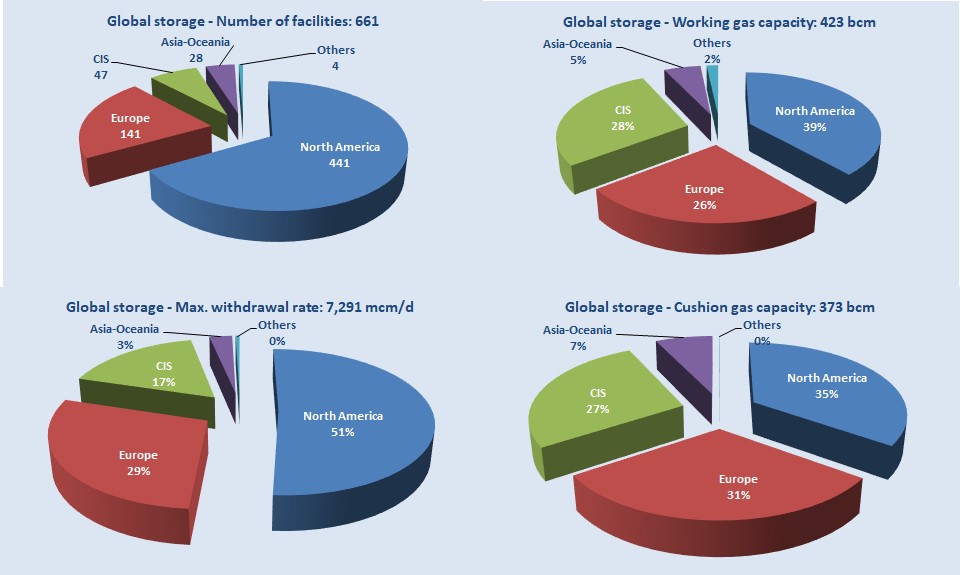

At the end of 2020, there were 661 UGS facilities in operation in the world. The global working gas capacity – 423 billion cubic meters (bcm) – remains almost unchanged compared to the previous year and is equivalent to 11% of the global gas demand.

- A market dominated by a few countries

United States, Russia, Ukraine, Canada and Germany account for almost 70% of worldwide capacities. Storage in porous formations (depleted fields and aquifers) dominate with 91% of global working gas volumes, but salt caverns account for 26% of global deliverability.

- A renewed interest in UGS: 17% more projects than in 2019

More and more governments around the world recognize the key role of UGS in providing security of supply, managing flexibility, optimizing production and grid operations, and dampening price variations and volatility. There are now 68 storage projects under construction in the world, adding 48 bcm of working gas capacity. All regions but Africa participate in the construction activity. China alone is expected to contribute around half of the total global capacity additions by 2025.

COMPLETE COUNTRY LEVEL DATA IN THE REPORT

Different market structures and regulations impact UGS trends

- http://www.link.ioChina: Storage is a strategic asset

Since 2018, the construction of natural gas storage infrastructure has been upgraded to a national policy. In March 2018, the National Development and Reform Commission required gas suppliers, city gas distributors, and local governments to have storage capacity equal to 10%, 5%, and 3 days of their annual sales or consumption, respectively, by the end of 2020. China has speeded up the building of storage facilities since 2018 and several new facilities were opened in 2021. During the 13th Five-Year Plan (2016-2020), the working gas capacity of UGS grew by 160% to 14.5 bcm in 2020.

- Russia: Refilling of domestic UGS is a national priority

In Russia, the replenishment of domestic UGS was a national priority in 2021 after an exceptionally harsh and long winter 2020/21 fully depleted UGS stocks. The pressure exerted by the need to replenish domestic UGS has undoubtedly restricted gas export capabilities: 21% of Gazprom production was pumped into storage during April-October 2021. UGS active working gas capacity reached 72.6 bcm at the beginning of November 2021.

- Notable differences in liberalized markets

In liberalized markets (Europe, US), storage replenishment is left to the market (although storage regulation has been introduced by some European governments), and the summer-winter price spread is the main parameter for shippers to value seasonal gas storage. But the seasonal spread has failed to send appropriate market signals for a decade (with the key exceptions of 2019 and 2020) and did not incentivize the replenishment of UGS facilities in 2021. In Europe, gas stock levels were the lowest of the last 6 years at the beginning of winter 2021/22. In the US, seasonal storage replenishment also depends on summer-winter spreads, which were minimal in 2021. Storage replenishment has therefore been lower than the five-year average during summer 2021, driving up Henry Hub prices, but gas stocks at the beginning of winter 2021/22 are within the five-year historical range.

- New gas market balancing strategies are emerging in South America and the Middle East

UGS are being built to allow stable production throughout the year and reduce LNG imports in the winter (Argentina), smooth out variations in seasonal demand and provide a readily available strategic reserve to respond to unexpected operational and market issues (Sharjah).

READ THE DETAILLED ANALYSIS IN THE REPORT

Sylvie Cornot-Gandolphe – CEDIGAZ

UNDERGROUND GAS STORAGE IN THE WORLD – 2021 STATUS

December 2021 – 47 pages PDF format