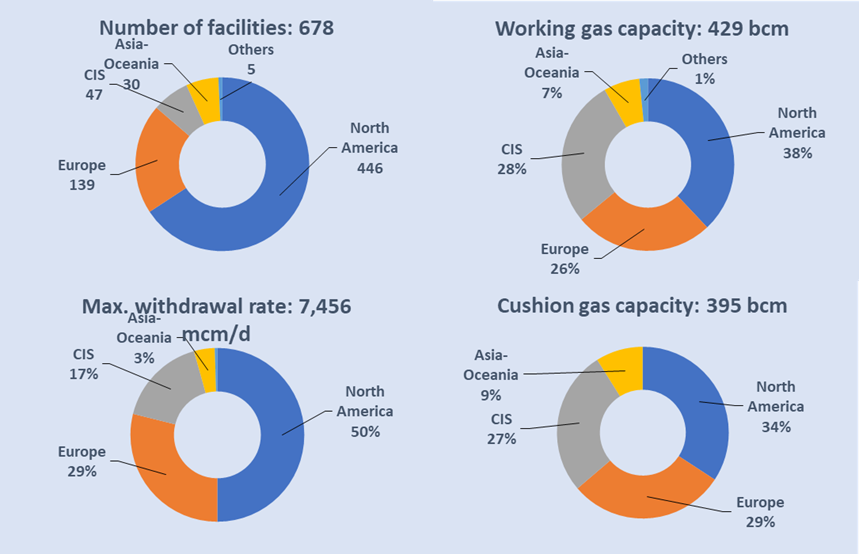

2022 witnessed a notable increase in UGS capacity, largely driven by the global gas crisis which emphasized the importance of storage for supply security. By the end of 2022, the working gas capacity reached 429 billion cubic meters, a 1.3% rise from the previous year, with significant contributions from China and Europe. The peak withdrawal rate also rose by 1.7%.

The storage market remains concentrated, but China’s UGS sees an accelerating growth

The storage market is largely concentrated in a few countries, with the United States, Russia, Ukraine, Canada, and Germany holding 68% of global capacities. However, there’s a growing focus on expanding storage in rapidly developing markets like China and the Middle East.

Depleted fields dominate storage, accounting for 81% of global working gas volumes, while salt caverns, which represents just 8% of global capacity, play a critical role in deliverability, making up for 26% of the global withdrawal rate.

The pipeline of UGS projects has expanded by 20% in 2022 compared to the previous year, indicating a growing recognition of UGS’s role in ensuring security of natural gas supply, balancing markets, and mitigating price volatility. Currently, 76 storage projects are under construction worldwide, adding 55 billion cubic meters of capacity. Additionally, there are 99 projects in planning stages, promising further growth.

Global underground gas storage at the end of 2022 – by region

The energy crisis, triggered by geopolitical shifts, prompted heightened focus on natural gas security and stability in policies worldwide, including Japan’s proposal for IEA-led international cooperation and Europe’s strategic RePowerEU plan to reduce reliance on Russian fuels.

The global energy crisis, notably triggered by Russia’s invasion of Ukraine, has brought profound changes in the gas market. The rebalancing of the European market relied heavily on increased LNG exports, particularly from the US, and a reduction in Asian imports, mainly by China. This shift has led to a more flexible and price-sensitive global LNG trade, but the strong competition between European and Asian LNG buyers and the tense geopolitical context led to unprecedented price levels and volatility.

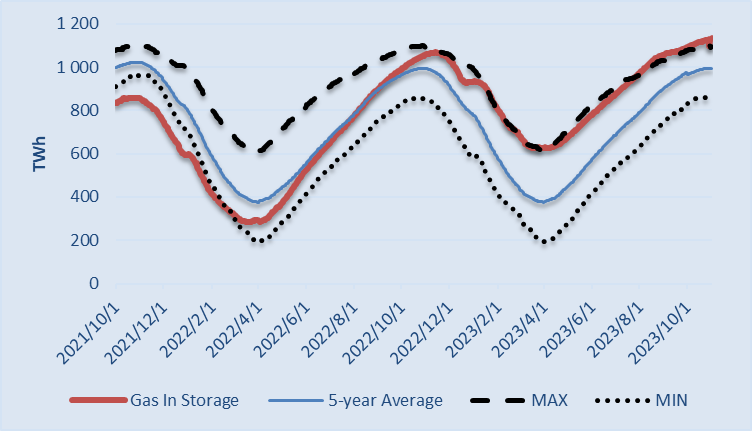

Policy-wise, governments globally are intensifying their focus on natural gas supply security and market stability. This includes stricter storage regulations and strategic LNG reserves. To enhance security, stability and sustainability of LNG supply, Japan has proposed to create a new framework for international cooperation among LNG producing and consuming nations led by the IEA. (for more on this, read our recent article entitled ‘From Crisis to Cooperation: Japan’s IEA-Led LNG Stability Framework Initiative’). Historically high stock levels in major markets ahead of winter 2023/24 indicate a more robust position than in the previous year, although potential supply/demand disruptions remain a concern.

Evolution of EU stock levels (1 Oct. 2020-1 Nov. 2023)

In Europe, the RePowerEU plan, launched in response to Russia’s invasion of Ukraine, includes measures to reduce dependency on Russian fossil fuels and enhance energy security. As part of this initiative, a new EU regulation mandates that gas storage facilities be filled to at least 80% of their capacity by 1 November 2022, with the requirement increasing to 90% in the following years. In 2022, these storage levels were exceeded, reaching 95% fullness by 1 November. This trend continued into 2023, with storage levels nearing full capacity by the same date.

Developments in Ukraine, US, China, and the Middle East

Other regions like Ukraine, the US, China, and the Middle East are also seeing significant developments in UGS. Ukraine’s capacity is being used as a “storage bank” by European traders, while the US is managing to increase LNG exports along with stock levels. China’s accelerated storage build-out has nearly doubled its capacity in five years. In the Middle East, countries are expanding storage to meet rising demand in various sectors.

By Sylvie Cornot-Gandolphe, Consultant on Energy Markets and Raw Materials, CEDIGAZ

UNDERGROUND GAS STORAGE IN THE WORLD – 2023 STATUS

November 2023 – 53 pages PDF format

Contact us: contact@cedigaz.org

CEDIGAZ is an international association with members all over the world, created in 1961 by a group of international gas companies and IFP Energies nouvelles (IFPEN). CEDIGAZ collects and analyses worldwide economic information on natural and renewable gases in an exhaustive and critical way.