2022 marked the worst natural gas and energy crisis in history due to the Russian invasion of Ukraine. The war in Ukraine has strongly impacted the global natural gas market because of the predominant role of Russian gas in European energy supply. Russian pipeline gas exports to Europe slumped to the lowest level observed since the mid-1980s, resulting in a loss of 77 bcm, equivalent to 20% of EU gas consumption in 2021, which had to be replaced. The global gas market was already tight in 2021 and the Russian gas supply crisis has thus further exacerbated the tightening and the volatility of gas markets. Prices of all commodities and energies spiked and the European gas prices in particular showed an exceptional volatility. Countries responded to energy security issues and high gas prices with gas-to-coal switching (Germany, Asia), energy savings and an acceleration of the development of clean energy technologies. Furthermore, the slower economic growth and the explosion in gas prices led to a destruction of industrial gas demand.

Global gas consumption fell 1.6%, with Europe recording the largest drop in history

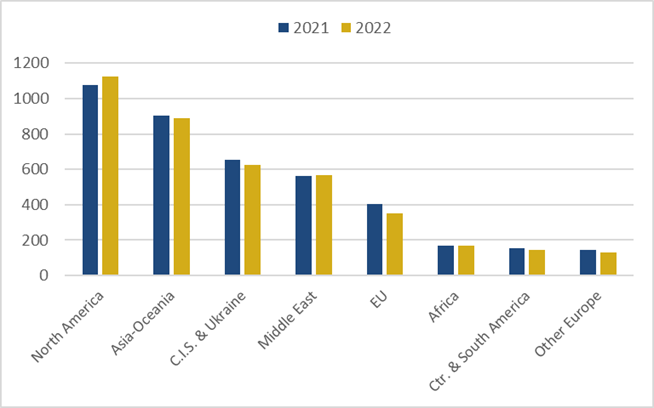

Global natural gas demand fell by an estimated 1.6% to 4000 bcm in 2022, according to the first estimates of Cedigaz. At the regional level, the largest declines in gas consumption were posted in the EU & UK (- 13%; – 60 bcm), the CIS & Ukraine (- 4.6%; – 30 bcm), and Asia-Oceania (- 1.6%; – 14 bcm), contrasting with regional growths in North America and the Middle East.

Exceptionally mild weather conditions reduced gas demand for the residential-commercial sector in many countries of the Northern Hemisphere. Furthermore, the slower economic growth (China) and the explosion in gas prices led to a destruction of industrial gas demand, energy savings, an accelerated development of renewable energies and a strong switching from natural gas to other fuels, especially coal for electricity in most Asian countries and Europe (Germany).

The year 2022 witnessed in particular the largest decline in EU gas consumption in history, down 13% to 353 bcm, under the impact of extremely wild weather conditions, energy savings, industrial demand destruction and fuel switching. The year 2022 also saw a historic decline in natural gas consumption in China (- 1.3%).

Global marketed gas supply flattened

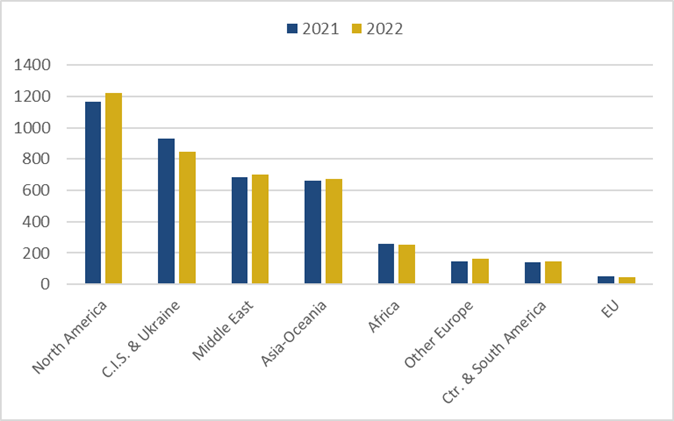

Global natural gas production was rather stagnant on a global scale in 2022. The sharp loss in Russian gas sales was compensated by a strong output growth in the United States (+ 41 bcm), and to a lesser extent, the Middle East (+ 14 bcm). On the international gas scene, the cut-offs of Russian pipeline gas supplies contrasted with a rapid ramp-up of US LNG supplies. The market share of the US in global production increased from 24% to 25%, while that of Russia fell from 18% to 15.5%.

At the regional level, North America increased its market share from 29% in 2021 to 30% in 2022, while the CIS saw its market share decline from 23% to 21%, followed by the Middle East (17%), Asia-Oceania (17%), Africa (6%), Europe (5%) and South & Central America (4%). As regards economic zones, the share of OECD countries in global gas supply increased from 38% to 40% annually to the detriment of the CIS.

Figure 1: Marketed gas production by region (bcm)

Source: Cedigaz

Figure 2: Natural gas consumption by region (bcm)

Source: Cedigaz

International gas trade recorded a strong contraction of 4.7% on plummeting Russian pipeline gas exports

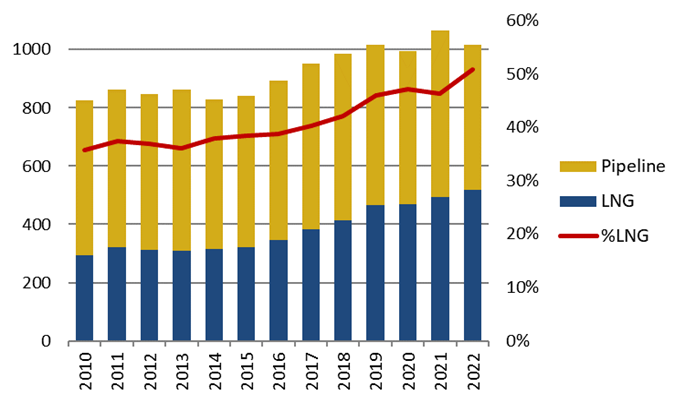

LNG became the best strategic short term alternative for Europe to withstand the slump in Russian gas exports. The year 2022 saw a noticeable expansion of LNG trade (+ 4.7%) but this latter failed to compensate for a historic and tremendous contraction (- 12.7%) of pipeline trade. In total, international gas trade dropped by 4.7% to 1016 bcm in 2022.

International net LNG flows exceeded that of pipeline flows for the first time in 2022. The share of LNG in international gas flows increased from 46% to 51%. The flexibility of the LNG industry played a key role to balance the European gas market in a context of a historic drop of LNG demand in China, especially spot LNG demand.

US flexible LNG played a key role in partially offsetting the shortfall in Russian pipeline gas deliveries to Europe and in maintaining EU gas supply security. US LNG impact was remarkable as it led to a transformation of the European gas supply. Russia lost its historic predominant position in terms of net pipeline exports and gas supplies to Europe to the benefit of Norway and LNG.

The Russian gas supply crisis has thus resulted in structural changes of the European gas supply, driven by energy security and the replacement of Russian fossil gas, renewed interest for LNG and an acceleration of renewable energies and low-carbon gases developments (biomethane, hydrogen).

Figure 3: Evolution of international gas trade and share of LNG (bcm)

Source: CEDIGAZ

International gas and LNG prices rose sharply to record levels in 2022

The global gas market was already tight in 2021 but the invasion of Ukraine and the widespread trade disruptions that followed exacerbated the tightening and the volatility of gas markets. Unprecedented tightness and energy security concerns caused prices of all commodities and energies to spike. Natural gas prices were the most volatile. The European prices in particular showed an exceptional volatility, which was reflected in an explosion of spot gas prices in Europe in August 2022. LNG prices have a growing impact on international gas prices, even in the US.

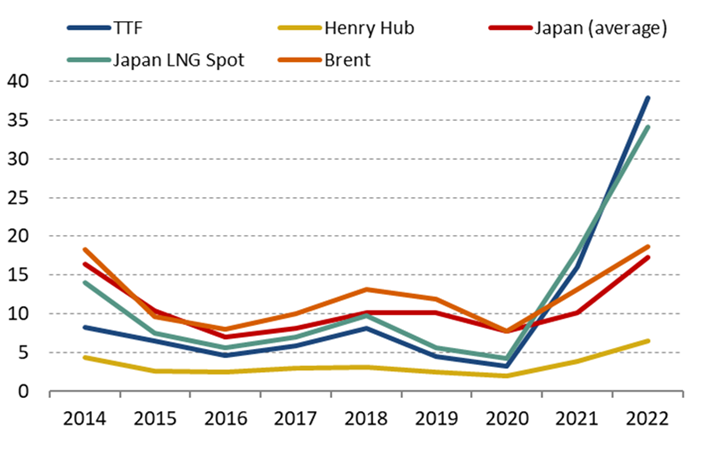

Figure 4: Evolution of annual international gas prices ($/MBtu)

Source: CEDIGAZ, Reuters, Argus, EIA

The strong global competition for flexible LNG supply, especially between Asia and Europe, put strong upward pressure on European spot prices. In Europe, the TTF price surged by 135% to 37.9 $/MBtu in 2022, compared to the average of 7$/MBtu over the 2015-2021 period. TTF was priced at a premium over Asia to attract spot LNG in a context of constrained LNG supply.

In Asia, LNG spot prices followed European prices, up 88% to 34.1/MBtu over the year, more than four times the 2015-2021 average. The correlation between the Asian spot LNG price and the TTF was very strong.

Gas and LNG storages played a key role to balance supply and demand, especially in Europe

Natural gas storage played an essential role to ensure gas supply security and balance global supply and demand. The gap between relatively stable production and declining demand in 2022 is explained by a strong storage build-up and lower than anticipated withdrawals of storages in Europe and Asia. In the European Union, targeted policy measures, record LNG inflows and a strong reduction of natural gas consumption resulted in record storage injections in 2022. Exceptionally mild temperatures in autumn delayed the European heating season. At the end of 2022, EU gas storage levels stood 20% above their five-year average. In Japan and South Korea, LNG stock inventories surged during the year and were well above historic averages. In the United States, storage levels were in line with the five-year average at the end of the year. Increased storage withdrawals were necessary in the US in 2022 to meet growing heating and power generation needs.

Following these developments and a relatively mild weather in the first quarter of 2023, Europe started the gas storage filling period at the end of March 2023 with record stock levels reaching 58 bcm, or 65% above the 2017-21 average. This highlights the essential role of EU gas storage to mitigate market tensions and ensure natural gas supply security this year.

For more information: contact@cedigaz.org

Cedigaz is an international association with members all over the world, created in 1961 by a group of international gas companies and the IFP Energies nouvelles (IFPEN). Dedicated to gas information, CEDIGAZ collects and analyses worldwide economic information on natural gas, renewables gases (biogas & hydrogen), LNG and unconventional gas in an exhaustive and critical way.