Irina Mironova for CEDIGAZ

TotalEnergies and its partners – Mitsui, ENH, Bharat Petroleum, Oil India, ONGC, and PTTEP – have lifted the four-year force majeure on the long-delayed Mozambique LNG project. The $20 billion onshore venture in Cabo Delgado province, suspended after the 2021 insurgent attack, returns to the spotlight as one of Africa’s most ambitious LNG developments.

TotalEnergies has requested government clearance for three key adjustments before resuming full activity:

- A $4.5 billion budget increase reflecting cost overruns during suspension;

- A revised start date, now targeted for the first half of 2029;

- A ten-year extension of the production license to align with the new schedule.

These requests illustrate the project’s evolving economics and the continuing operational constraints in northern Mozambique, where access remains restricted by air and sea.

The context of LNG infrastructure in Africa and Mozambique

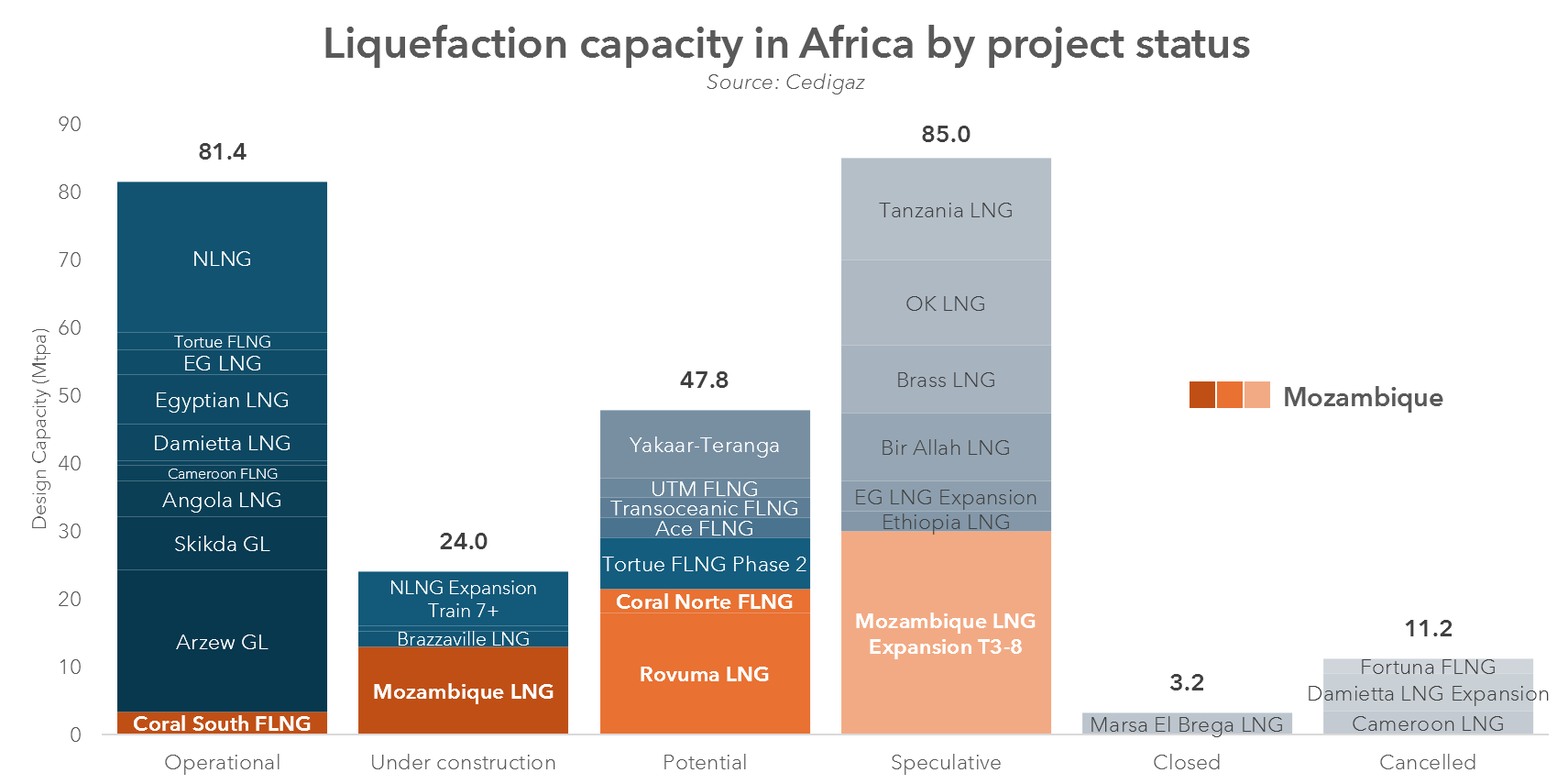

At 12.9 Mtpa, Mozambique LNG is the largest liquefaction project under construction in Africa, representing over half of the continent’s capacity now being built. It adds to a list of LNG ventures in the country:

- Coral South FLNG (Eni), 3.4 Mtpa, operational since 2022;

- Coral Norte FLNG (Eni), 3.5 Mtpa, FID reached in October 2025, with first gas targeted for 2028.

If realized, Coral Norte FLNG and Mozambique LNG could lift Mozambique’s aggregate LNG capacity above 20 Mtpa by the end of the decade, positioning the country alongside Nigeria and Angola as a key African gas exporter. Furthermore, Rovuma LNG (ExxonMobil, Eni, CNPC, GALP, KOGAS, ENH), 18 Mtpa, is in the FEED stage, with FID postponed to 2026 amid financing and security hurdles.

Summary

Mozambique’s restart adds a new variable to the global LNG supply outlook. The project was not included in the IEA’s Gas 2025 medium-term projections, but the lifting of force majeure suggests these volumes could re-enter the post-2030 balance. Coral Norte FLNG Mozambique LNG and Rovuma LNG together could bring well over 30 Mtpa of new capacity once fully developed – a significant contribution from a single country. For global markets, these projects illustrate Africa’s role as a major LNG growth frontier, but they also add to the oversupply wave expected at the turn of the decade.