By Irina Mironova for Cedigaz

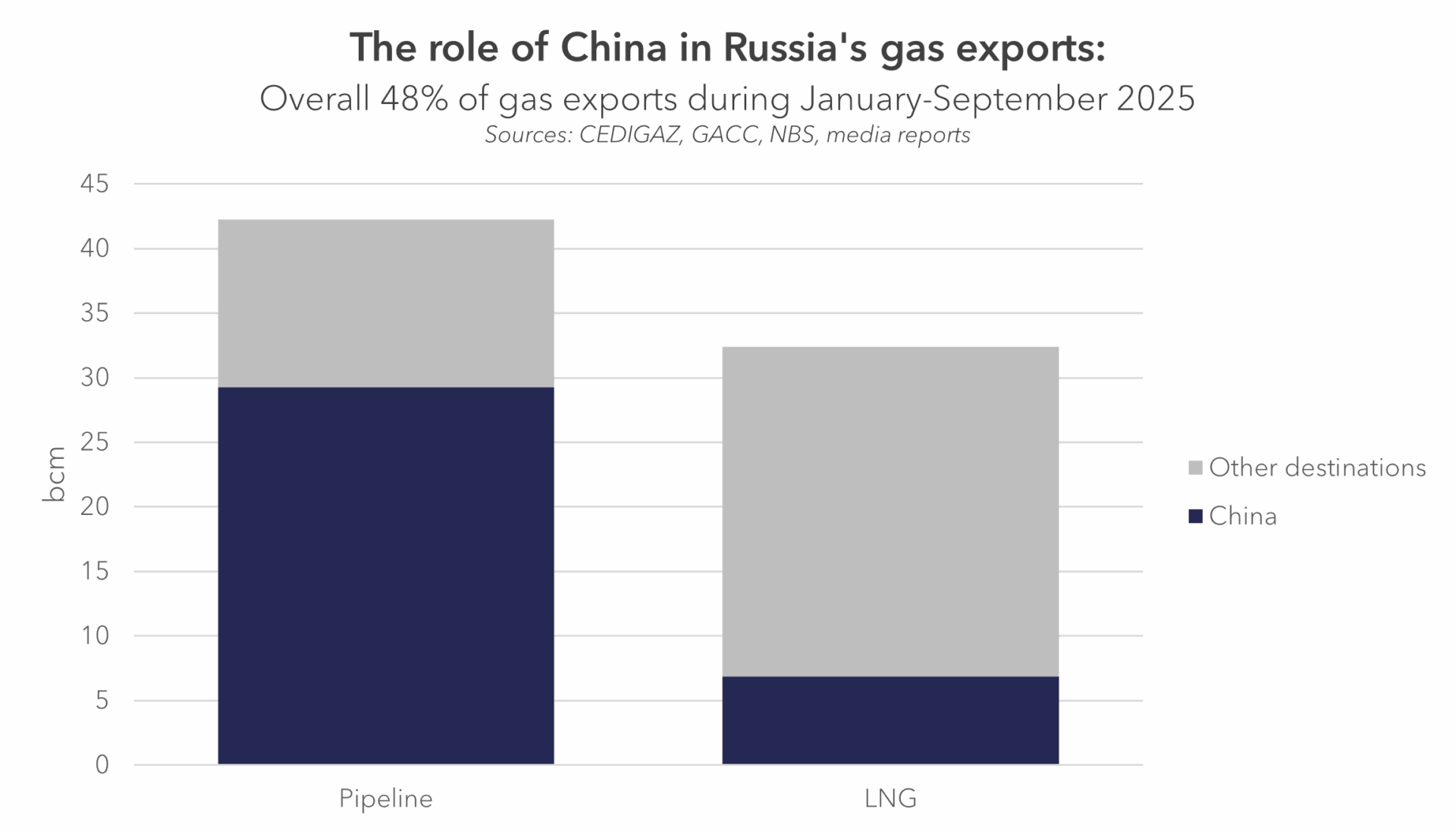

Russia’s gas trade with China continued to evolve in 2025, demonstrating a growing structural reliance on the Chinese market across both pipeline and LNG channels. While recent political signals – including the Power of Siberia 2 memorandum at the SCO Summit and the direct deliveries from Arctic LNG 2 to China’s Beihai LNG terminal – attracted considerable attention, the underlying trade data point to a more nuanced picture. China’s LNG imports from Russia rose seasonally in September, in line with typical autumn patterns rather than representing a record-breaking surge, and cumulative LNG deliveries over January–October remained lower year-on-year. This dynamic highlights an increasingly asymmetric relationship: Russia is becoming more dependent on China to absorb redirected pipeline gas and discounted LNG, whereas for Beijing, LNG continues to serve a flexible balancing role, with limited structural growth in underlying demand.

Seasonal LNG increase, not a structural surge

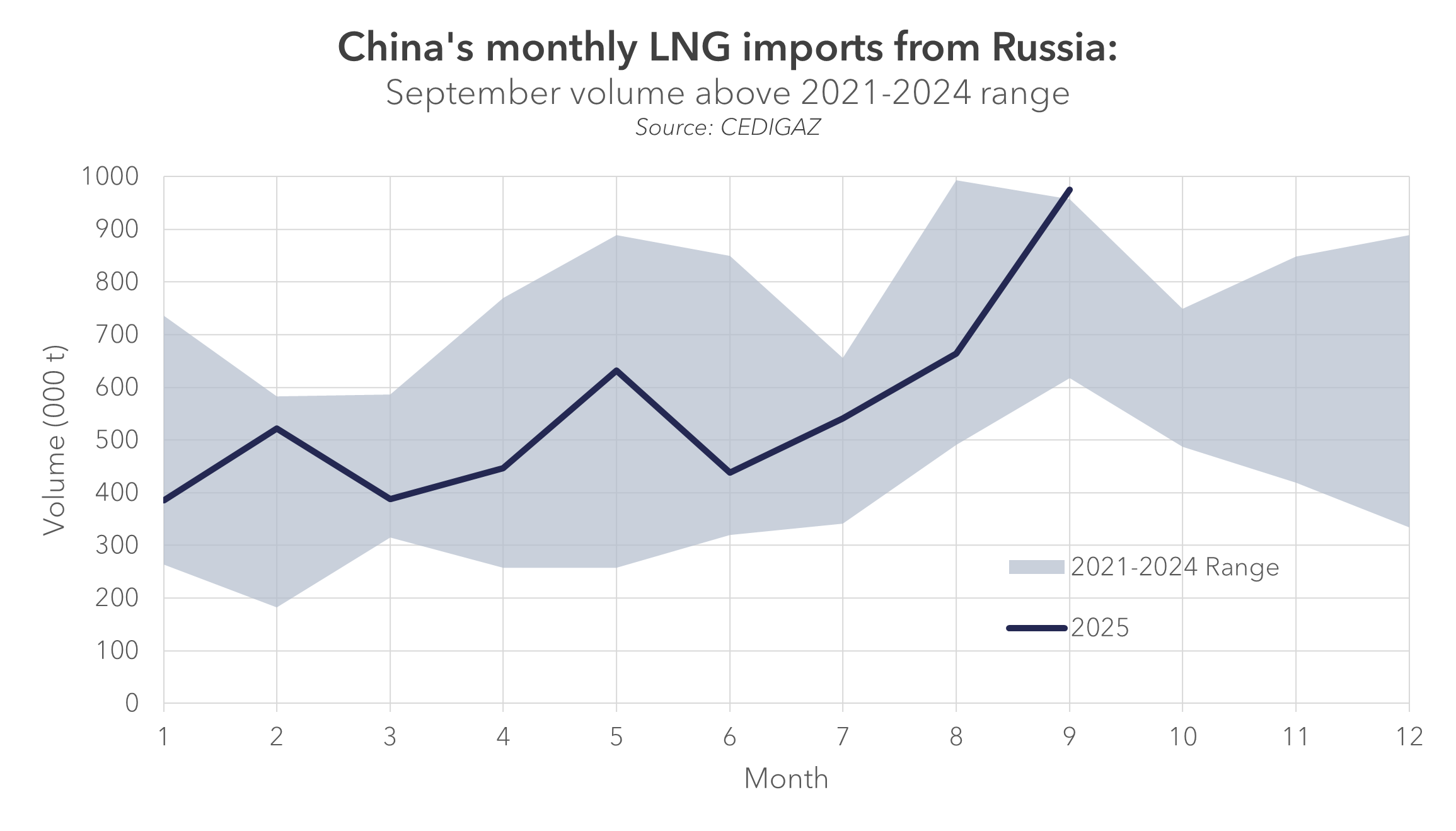

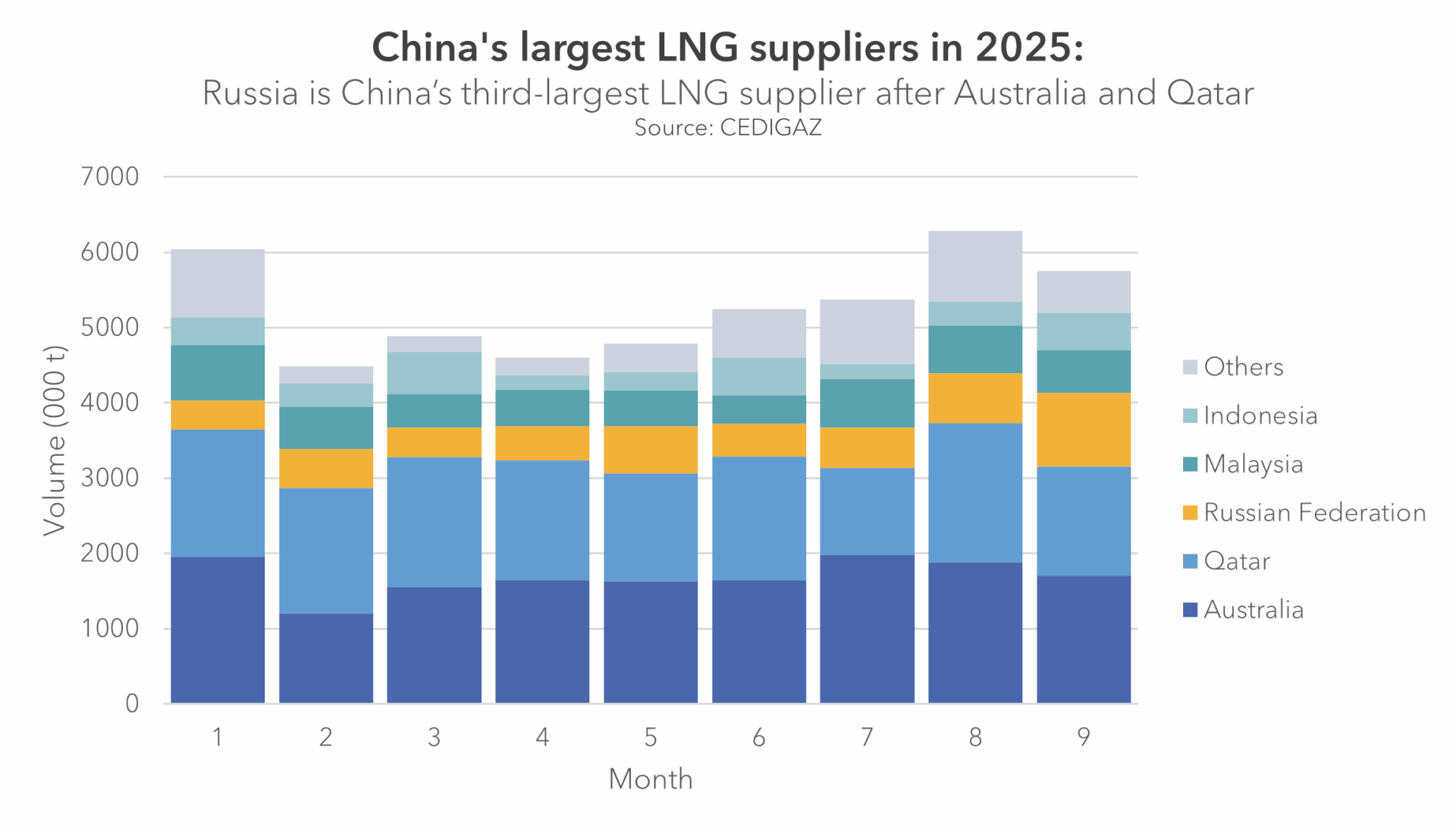

In September 2025, Russia delivered a relatively high monthly volume of LNG to China above the 2021–2024 range. This placed Russia as China’s third-largest LNG supplier for the month, following Australia and Qatar while overtaking Malaysia. The increase was driven primarily by seasonal factors and short-term optimisation rather than by a structural change in trade patterns.

Despite the strong September figure, cumulative It is not that surprising given Chinese LNG imports of all origins declined by 16%, Several factors contributed to this outcome: supply constraints at Russian LNG facilities earlier in the year; the loss of access to European transshipment points, which has complicated Atlantic–Pacific logistics. Even with this decline, Russia has gained its position as China’s third-largest LNG supplier.

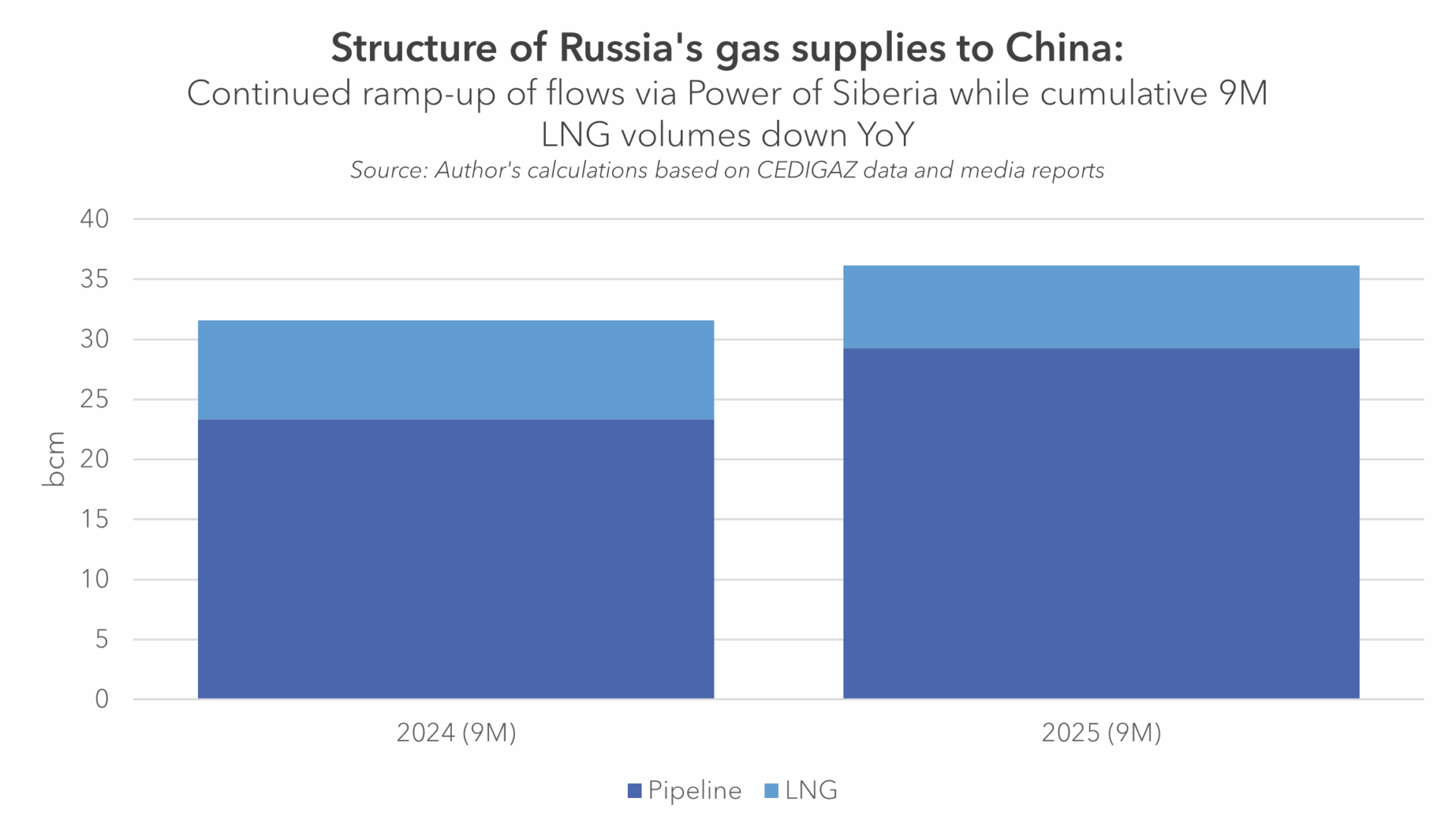

At the same time, pipeline supplies via the Power of Siberia system continued to expand. Russian pipeline exports to China reached new daily highs in 2025; total 9M pipeline volumes rose year-on-year, more than offsetting weakness seen in LNG deliveries.

Growing asymmetry in the Russia–China gas relationship

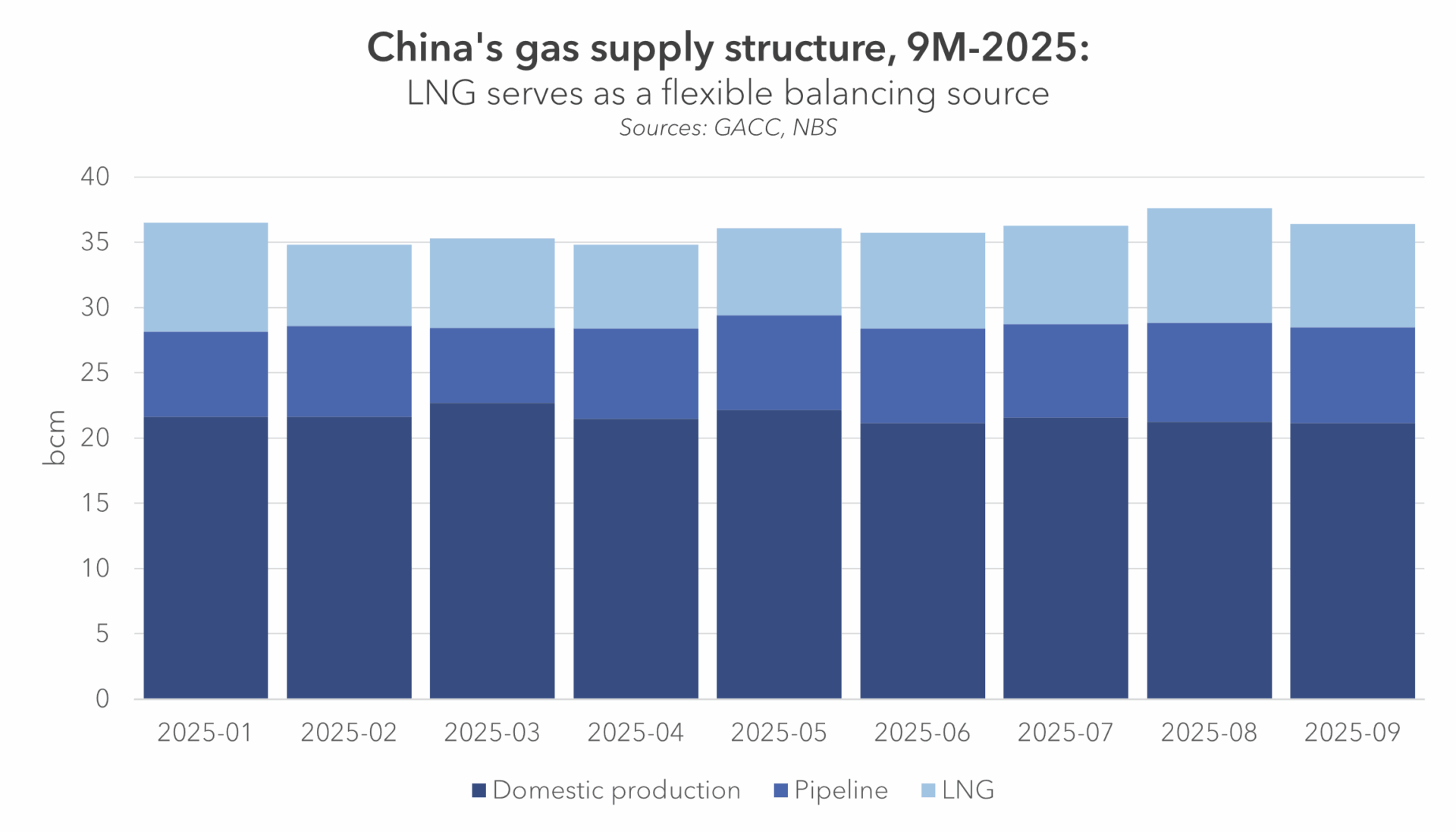

The combined LNG and pipeline data illustrate a broader structural shift. Within China’s gas system, LNG increasingly acts as a marginal balancing source, adjusting to seasonal demand cycles and import optimisation strategies. Pipeline supplies, supported by long-term contracts, lower prices and stable operational patterns, have become the backbone of China’s imported gas. In 2024–2025, LNG consistently accounted for between 45% and 55% of China’s total gas imports, but the share has been edging downward.

This divergence contributes to a widening asymmetry in the bilateral relationship. For Russia, China is becoming the primary outlet for both pipeline gas and incremental LNG volumes redirected from European markets.

Outlook: Russia’s ability to sustain flows

Looking ahead, Russia’s capacity to sustain or expand its LNG deliveries to China will depend on several operational and market factors: utilisation levels at Yamal LNG and Sakhalin-2; the extent to which Arctic LNG 2 can operate under sanctions constraints; access to non-EU transshipment points such as Kildin; and competition from Middle Eastern and Australian suppliers in Asia.

A key uncertainty lies in the future of U.S.–China LNG trade. Since February 2025, China has halted U.S. LNG imports due to tariff escalation, making direct deliveries commercially unviable. Around 90% of China’s long-term U.S. portfolio is contracted on FOB terms, enabling Chinese buyers to lift cargoes in the U.S. Gulf and redirect them to Europe or other markets. China continues to monetise these contracts even without domestic imports.

If tariffs were relaxed or removed, U.S. LNG could rapidly re-enter the Chinese market. Given that Chinese buyers have over 20 Mtpa of long-term U.S. supply, normalisation would activate a large pool of destination-flexible volumes capable of directly competing with Russian LNG. This reinforces the point that Russia’s position in the Chinese market, while significant, remains exposed to shifts in global trade patterns.