Portfolio players have reshaped the LNG market. Their rise has accelerated project sanctioning, deepened liquidity, and blurred the traditional boundaries between sellers and buyers. Yet the balance of risk has shifted. While projects retain revenue certainty through take-or-pay (ToP) clauses, buyers (particularly portfolio traders), now carry the market-cycle exposure. Their flexibility is valuable in tight markets but becomes a liability in periods of oversupply.

The Rise of Portfolio SPAs

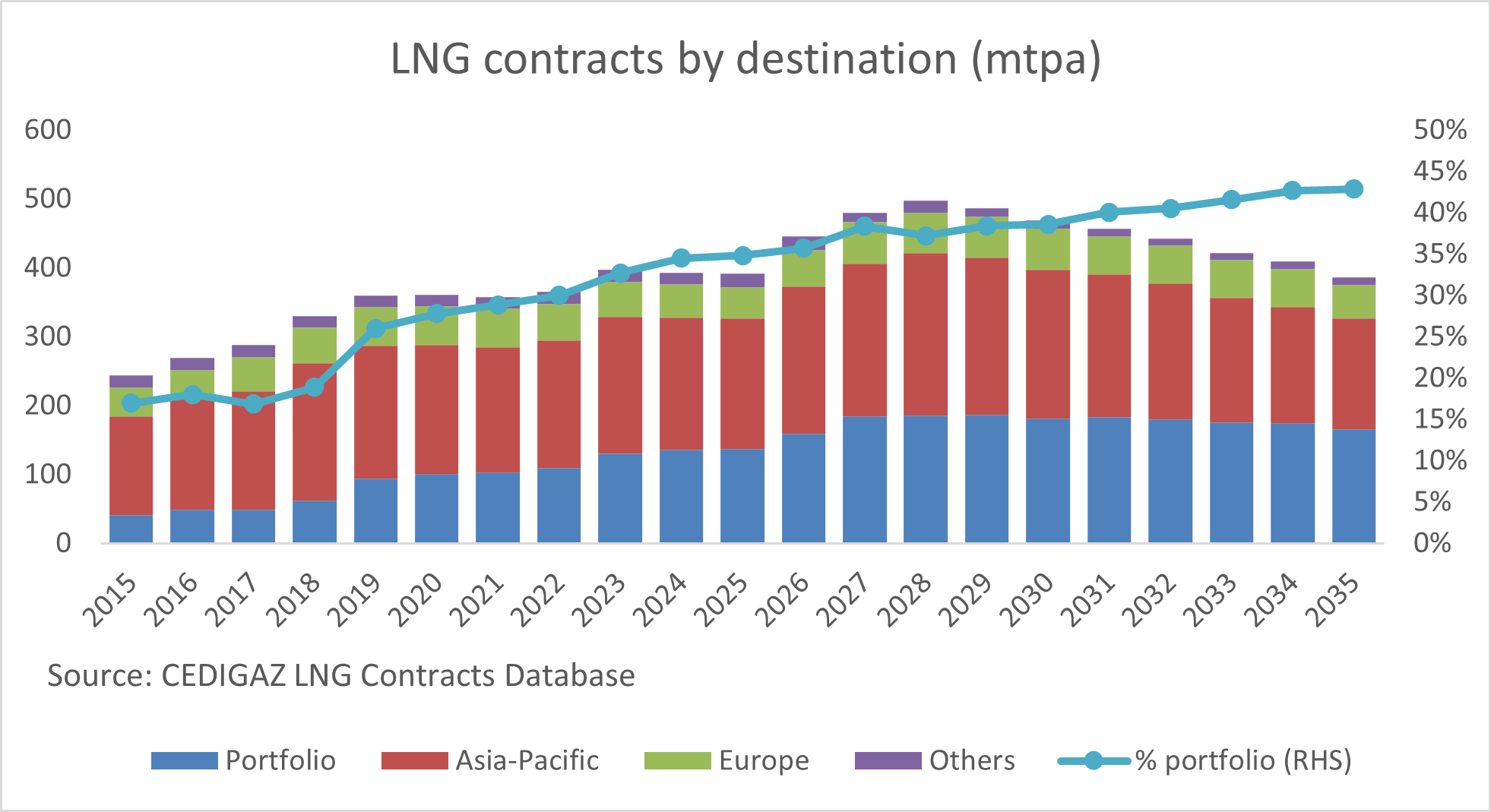

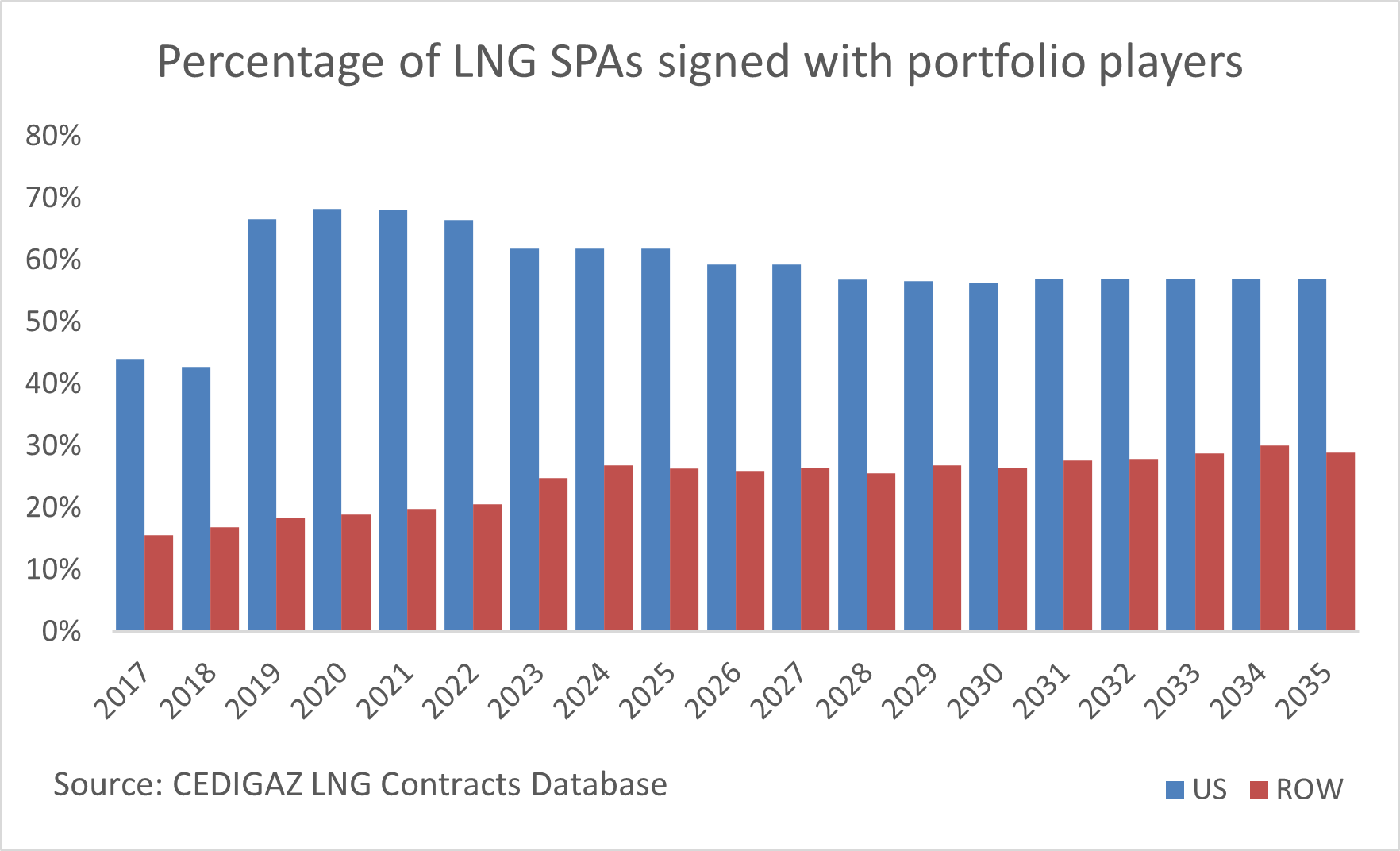

Portfolio growth has become a defining feature of the LNG market. Both established players and new entrants, especially U.S. project developers, increasingly rely on portfolio players and commodity traders to secure long-term SPAs.

Unlike utilities or industrial end-users, portfolio buyers purchase LNG for trading and resale, responding to global arbitrage opportunities rather than domestic demand. Their presence has facilitated fast offtake contracting, particularly for developers such as Venture Global and NextDecade.

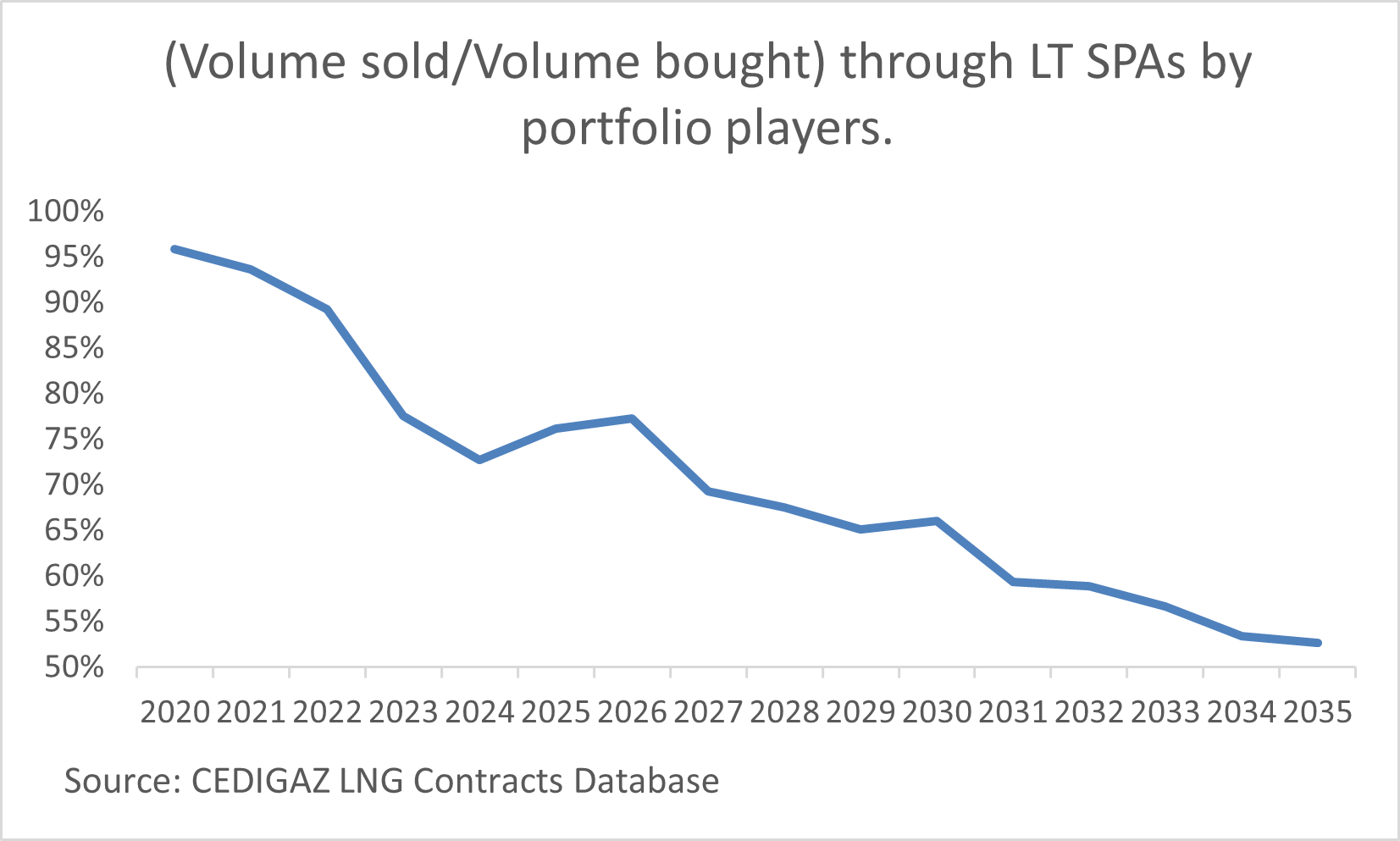

As shown in the chart below, portfolio players’ long-term import volumes (volumes bought) increasingly exceed their export commitments (volumes sold). This indicates that portfolio companies are relying more on the spot market to place uncommitted cargoes.

The growing dominance of such players in long-term contracting has blurred the distinction between buyers and sellers. These entities sign contracts without necessarily having final consumers, creating a floating layer of LNG volumes circulating between regions. This flexibility, while balancing the market in tight conditions, can amplify financial pressure on portfolio buyers during price collapses.

Structural Exposures Behind Portfolio Contracts

Every portfolio contract embeds financial exposures across price indices and regions:

- On the buying side: traders are “short” supply legs. They lose when feed-gas or oil prices to which feed gas may be indexed rise unexpectedly.

- On the selling side: they are “long” destination markets such as Europe or Asia, profiting when regional hub prices exceed supply costs.

The trading logic that underpins these positions means that portfolio buyers’ willingness to lift cargoes depends less on physical need and more on margin preservation. When those margins disappear, the offtake commitment remains: they must still pay under ToP clauses.

Their profitability – and therefore their willingness to lift volumes – depends on the spread between these indices. When spreads narrow or invert (e.g., Asia ≈ Henry Hub + shipping), portfolio players may: defer cargoes, seek to renegotiate terms, or resell at a loss rather than take delivery.

For project developers, this means that contract fulfilment becomes contingent on trading economics rather than end-user necessity. This is a fundamental shift in counterparty behaviour: developers keep contractual security, while buyers inherit operational and financial volatility.

The U.S. LNG Case: Growth Built on Portfolio Buyers

The U.S. model has benefited enormously from this trend. Portfolio SPAs allowed developers to reach FID quickly without waiting for sovereign or utility anchor buyers.

But the same feature now increases exposure to market cycles. For sellers, project cash flow remains largely intact. For buyers, however, ToP commitments transform flexibility into fixed exposure. If many portfolio buyers seek to delay or redirect cargoes simultaneously, liquefaction utilisation may fall – yet fixed liquefaction fees continue to accrue.

The U.S. model remains structurally more exposed to market cycles, as is evident from the figure above. Speed to FID has been achieved at the expense of structural contract resilience.

Long-Term Market Implications

As global supply expands post-2026 with new capacity from Qatar, the U.S., and Africa, portfolio-dominated offtake could become a liability. Under high portfolio concentration, buyers face the challenge of monetising volumes in an increasingly crowded spot market.

If prices remain low or regional spreads narrow, portfolio players – rather than project developers – will have to absorb the imbalance.

Takeaways

The rise of portfolio behaviour has undeniably accelerated LNG project development and market liquidity. But when such contracts dominate an offtake mix, traditional assumptions (firm liftings, utility credit, destination certainty) are weakened.

In addition, the LNG market’s risk frontier has moved downstream. Developers continue to enjoy bankable ToP protection; portfolio buyers now act as the system’s shock absorbers. In the next supply wave, it is their trading flexibility that will be tested.

Flexibility remains valuable, but as supply outpaces demand, portfolio players may find that optionality without offtake certainty becomes their biggest vulnerability.

By Irina Mironova for CEDIGAZ

References

- Oxford Institute for Energy Studies (2023). LNG Contracts in the Context of Market Turbulence and an Uncertain Future (Paper NG 187).

- Institute of Energy Economics, Japan. (2018). Emergence of LNG Portfolio Players.

- International Energy Agency (2025). Gas 2025 – Analysis.