By Irina Mironova for Cedigaz

As Europe’s gas market recalibrates after three years of upheaval, Türkiye is positioning itself as both a physical and commercial hub. A combination of robust pipeline inflows, moderate LNG demand, and a steady expansion of trading and storage capacity supports Ankara’s ambition to anchor regional gas flows.

Türkiye is the fourth largest gas market in Europe and plays a critical role in the region’s energy landscape. It handles approximately 10% of the European Union’s gas imports through transit and serves as a key LNG enabler for Eastern Europe. With an estimated spare import capacity of 25–30 bcm per year, it supplies LNG, Azerbaijani gas, and Russian gas to neighbouring countries.

2025 trend: pipeline comeback?

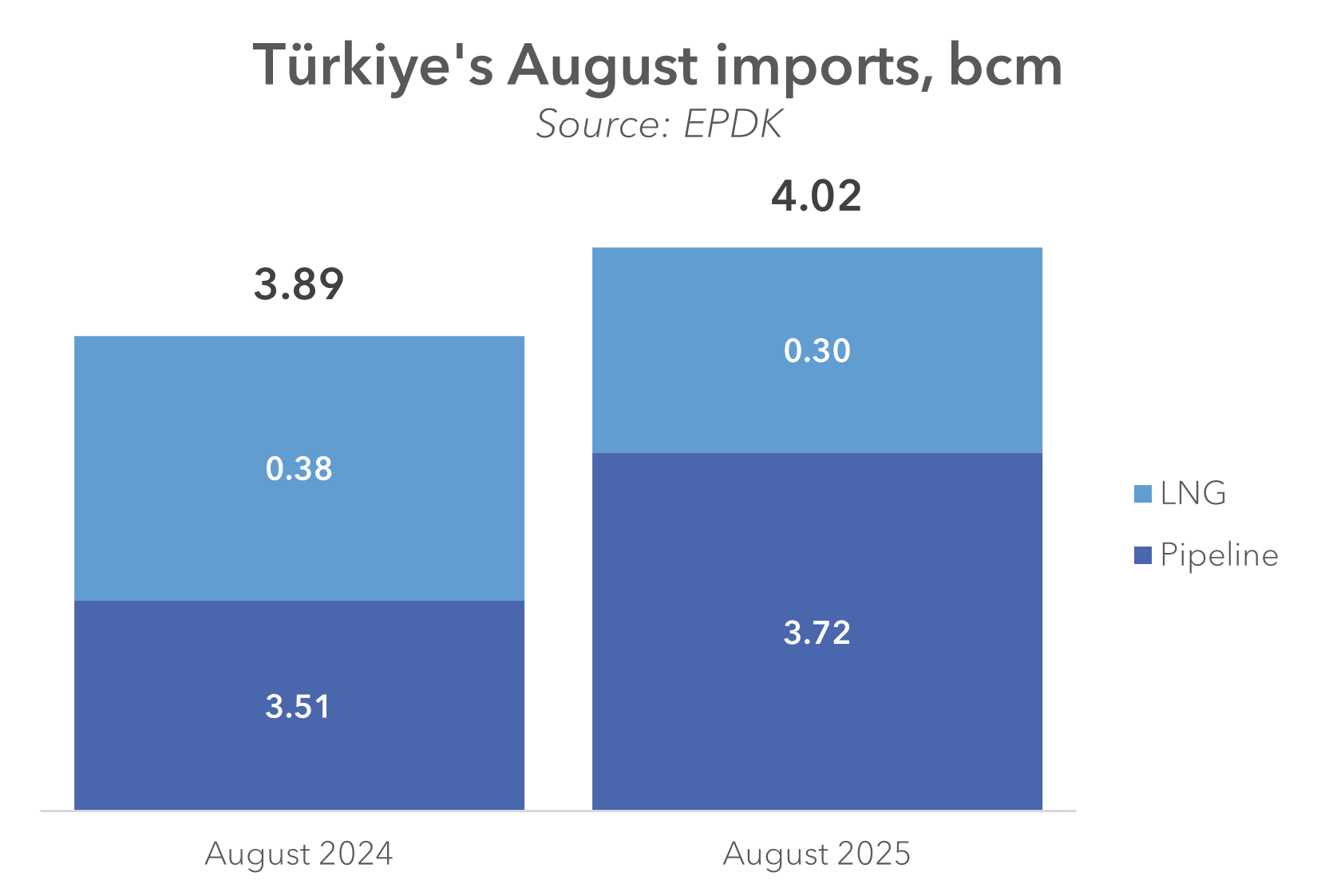

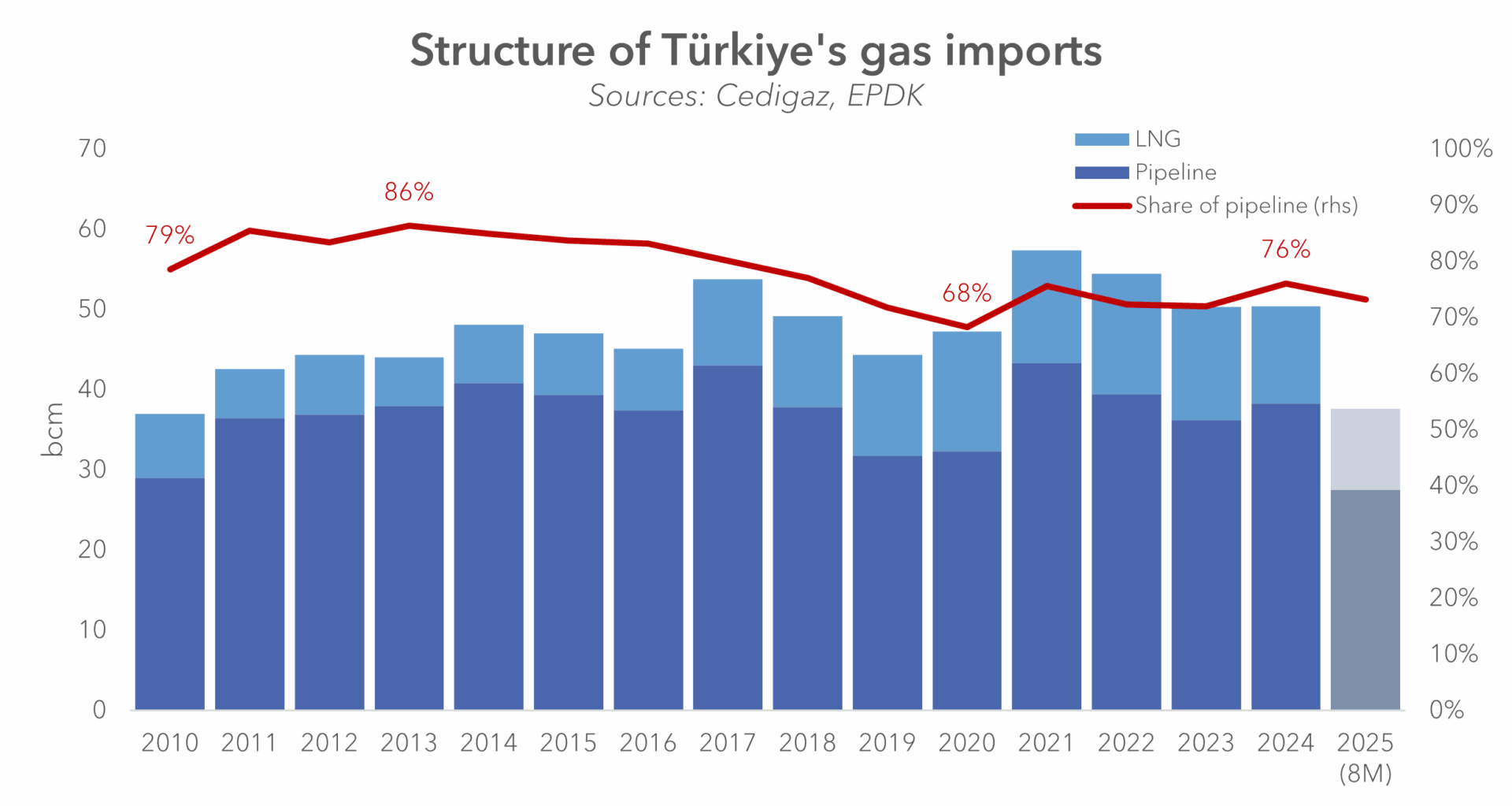

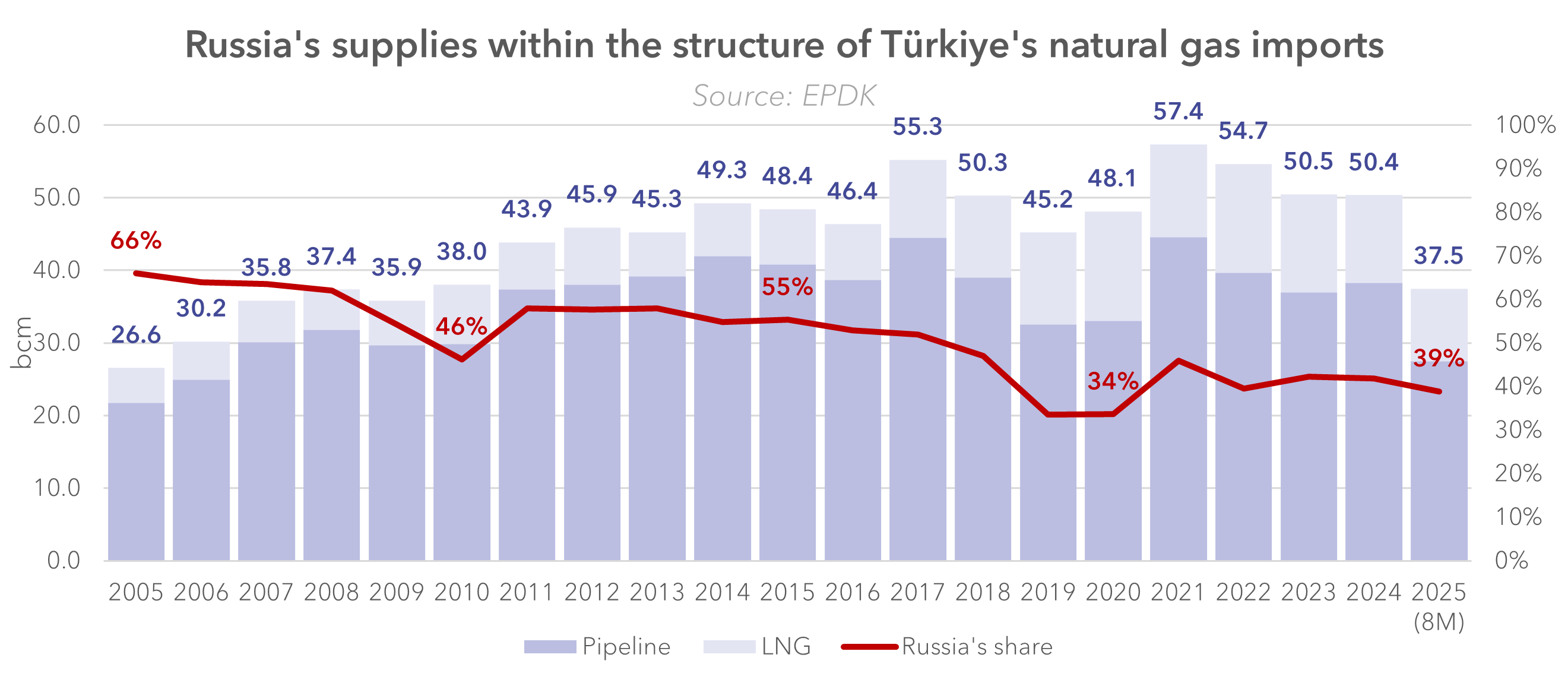

According to EPDK statistics, Türkiye imported about 4 bcm of gas in August 2025, up 3.3% year-on-year. Pipeline deliveries accounted for the entire increase, rising 6% y/y to 3.7 bcm, while LNG imports dropped over 22% to 0.3 bcm.

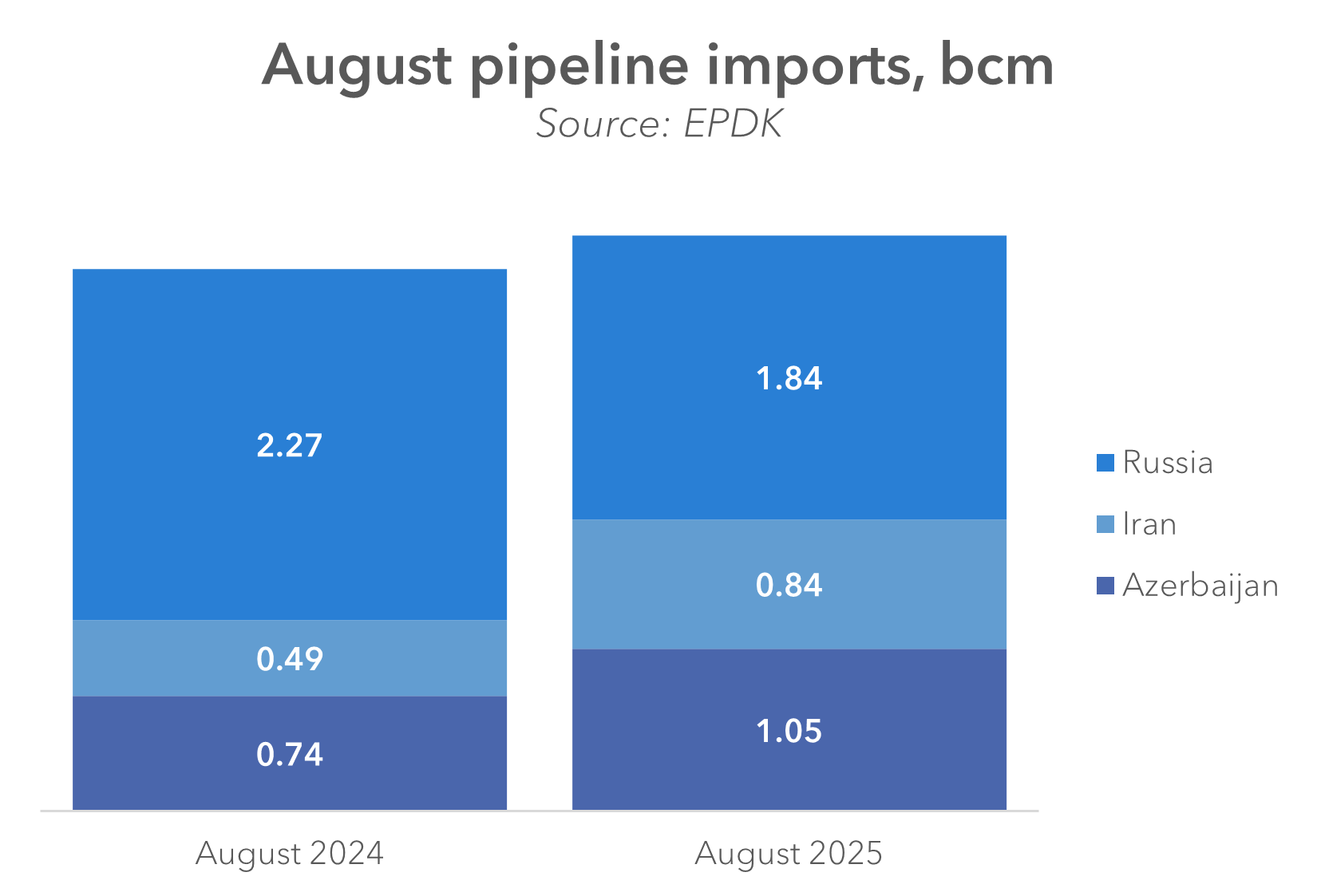

Azerbaijan sent 1.05 bcm (+41 % y/y) through TANAP, securing the second place behind Russia, whose flows declined from 2024 levels.

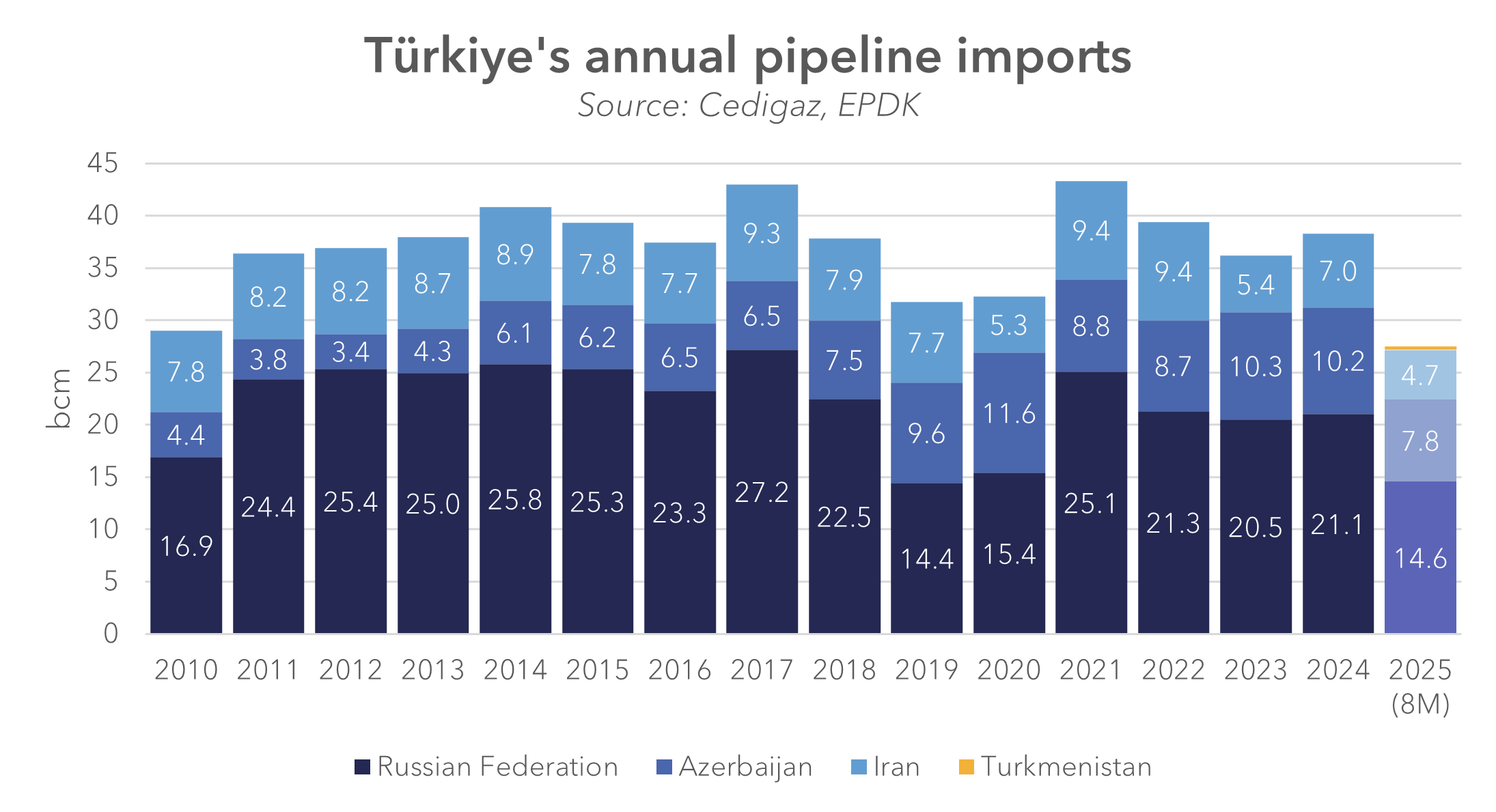

Until 2018, Iran was the second largest pipeline as supplier to Türkiye, but in the recent years, Azerbaijan took over.

The slight rebound in pipeline gas reflects both economics and availability. Oil-linked Russian contracts have remained competitive against spot LNG , while maintenance work at global liquefaction projects constrained spot cargoes in early 2025. Moreover, transit agreements with Bulgaria and Hungary have expanded Türkiye’s re-export options for Russian and Caspian gas, encouraging higher throughput on the westbound corridor.

Natural gas supply structure in 2024 was 76% pipeline, 24% LNG.

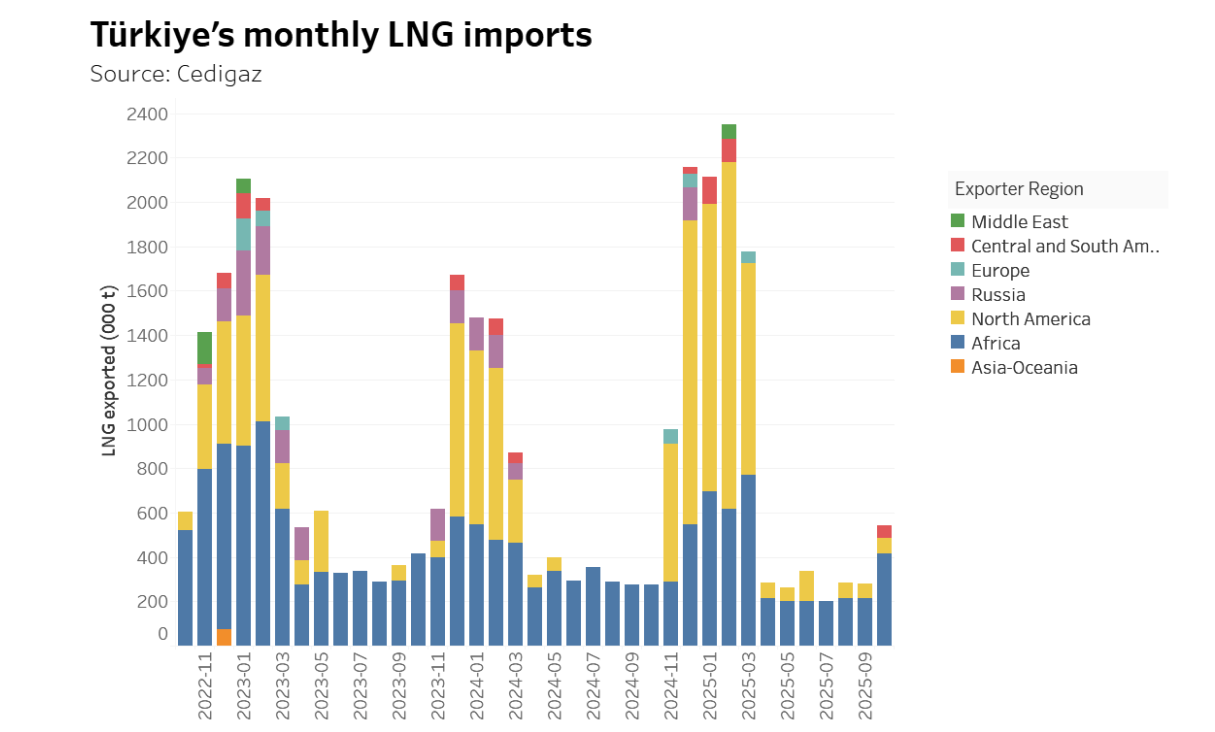

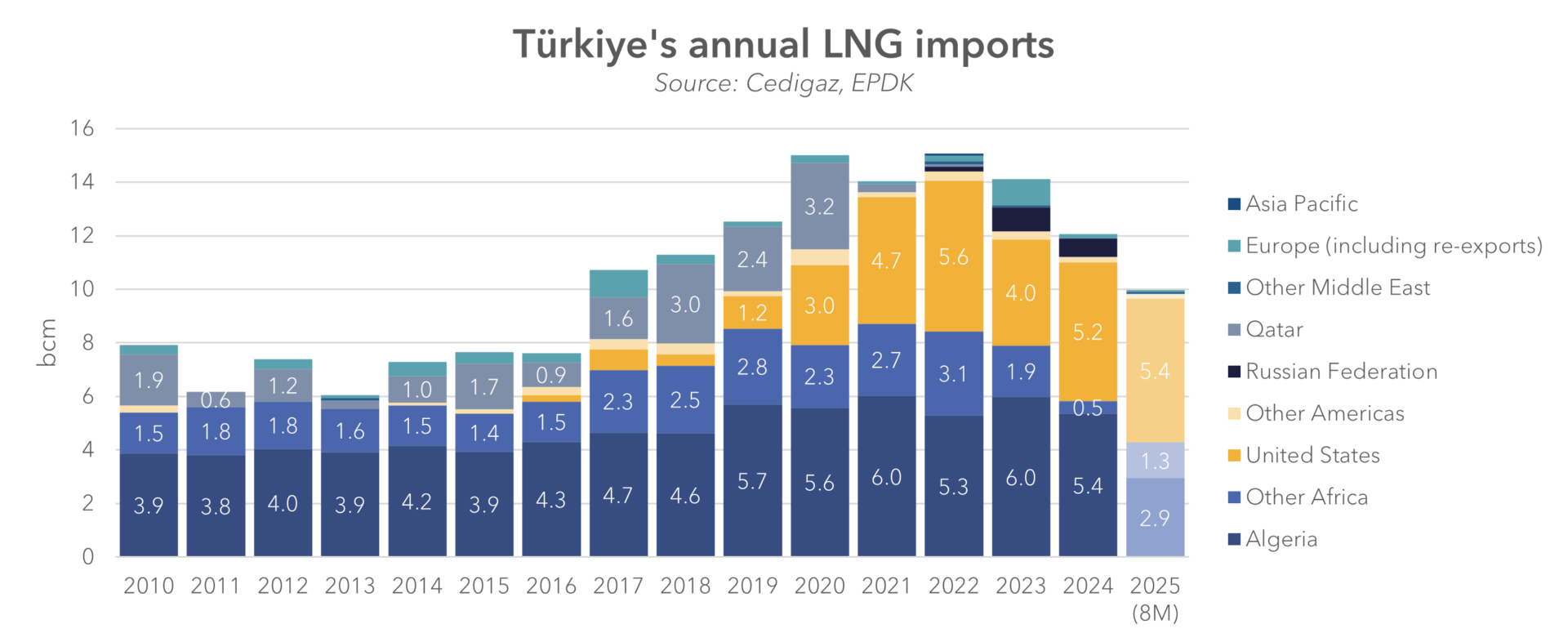

LNG: Structural Cushion, Cyclical Weakness

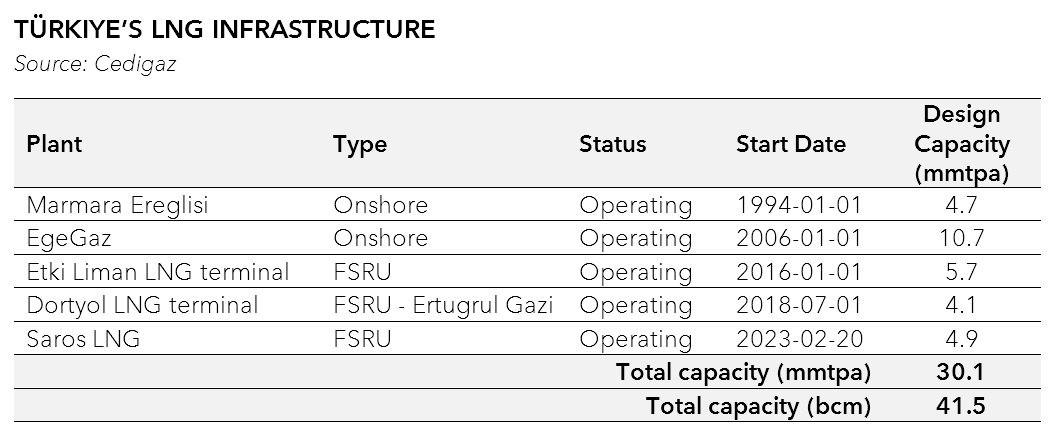

Türkiye’s LNG infrastructure – five terminals with combined regas capacity above 40 bcm per year – gives the market flexibility to arbitrage seasonal price differentials.

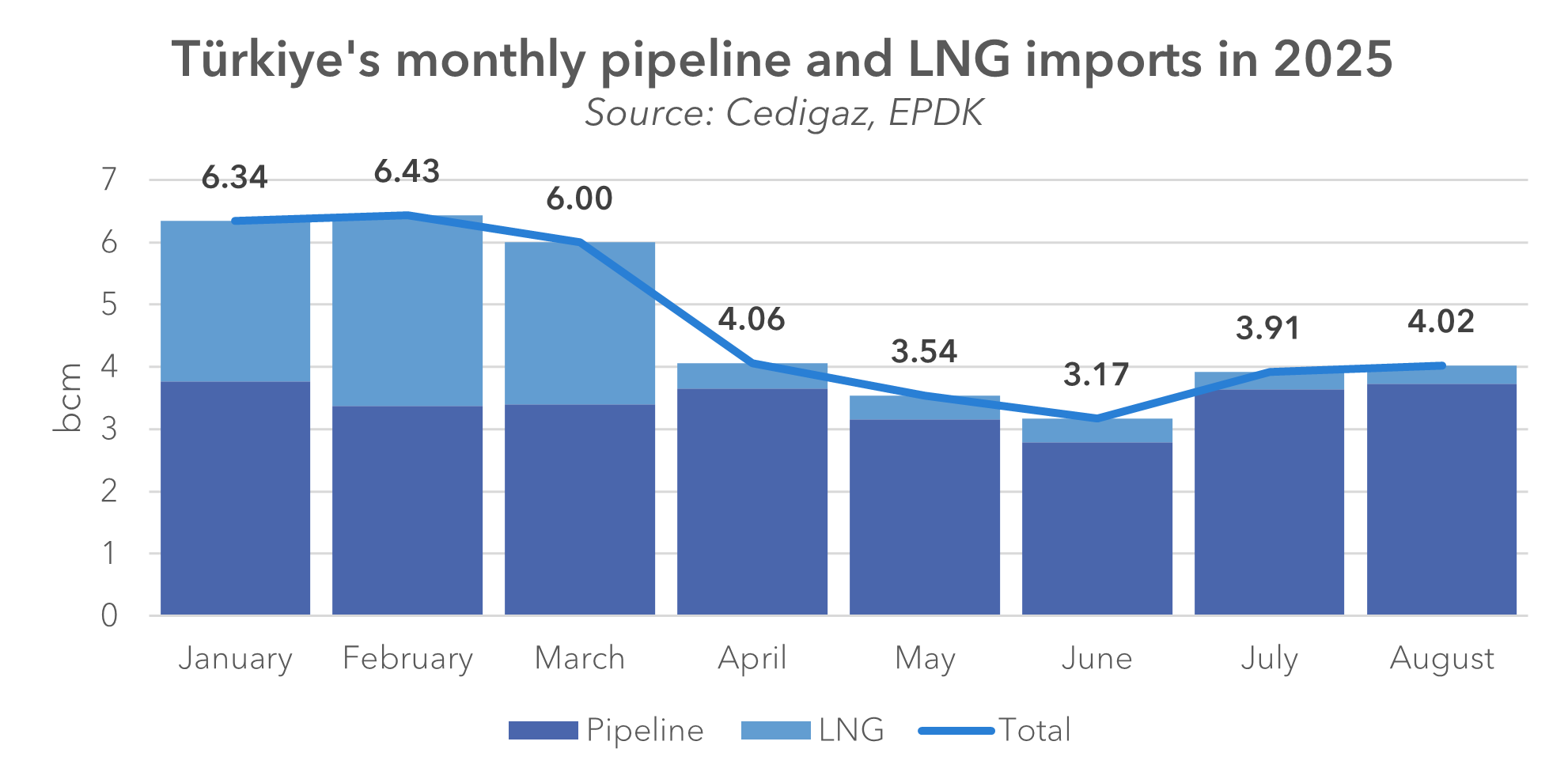

Yet utilisation has been volatile. Imports plunged in H1 2025 despite the commissioning of new storage tanks and long-term capacity reservations by BOTAŞ and private shippers.

Spot LNG prices remained relatively high compared with oil-indexed pipeline formulas, and storage inventories were ample following a mild winter. As a result, pipeline gas covered nearly all incremental demand, reversing the trend of 2023–2024 when Türkiye relied more heavily on LNG to manage peak consumption.

Hub Strategy and Market Architecture

Türkiye’s government continues to advance the Natural Gas Hub Project, launched in 2022 and refined through the Energy Market Regulatory Authority’s (EPDK) successive liberalisation steps. The key pillars are:

- Infrastructure integration: Ongoing upgrades of the Thrace gas network, expansion of the storage sites (target 11 bcm working capacity by 2028), and digital coordination between BOTAŞ and the Istanbul Energy Exchange (EPIAŞ).

- Transparent pricing: Development of a Türkiye Gas Reference Index (TGREF) based on daily EPIAŞ trades and cross-border nominations. Volumes on the electronic platform have grown steadily, exceeding 600 mcm per month in mid-2025.

- Cross-border trading: New interconnection codes with Bulgaria, Greece, and Hungary enable private companies to nominate gas for re-export, broadening liquidity beyond BOTAŞ’s portfolio.

At Gastech 2025, officials reiterated that the hub’s purpose is not to compete with TTF or the Italian PSV, but to provide a regional balancing point linking Caspian, Middle-Eastern, Eastern-Mediterranean, and Russian flows into South-Eastern Europe. Ankara aims to institutionalise this function by 2030 through harmonised tariffs and data transparency aligned with EU ACER standards.

Strategic Geography, Complex Politics

Türkiye’s dual identity as both a consumer of 50–55 bcm per year and a transit country for over 100 bcm of capacity makes it highly relevant to Europe’s diversification goals. The Southern Gas Corridor through Azerbaijan, Georgia, and Türkiye remains the most credible incremental supply route to the EU, while prospective extensions such as TAP Phase II and Ionian-Adriatic linkages depend on stable Turkish transit.

At the same time, Ankara balances delicate supplier relationships. It continues long-term contracts with Russia’s Gazprom (under review for partial indexation to hub prices) and with Iran, whose exports resumed after maintenance outages earlier this year. Commercial arrangements with Turkmenistan, including swap deliveries via Iran and potential participation in the Trans-Caspian link, illustrate Türkiye’s intent to broaden its supplier base without alienating existing partners.

From Transit State to Market Maker?

Türkiye’s evolving gas portfolio positions it to play a moderating role in Europe’s supply equation over the next decade. By combining secure pipeline inflows, scalable LNG capacity, and emerging trading infrastructure, Ankara can smooth regional imbalances.

However, realising this vision will require further liberalisation of domestic pricing, transparent third-party access, and alignment with EU market governance. Without these steps, Türkiye risks remaining a transit corridor rather than a fully fledged hub.

In short, 2025 marks a turning point: the country is leaning back toward pipeline gas, but not away from LNG. Instead, it is calibrating the two to underpin its ambition to become the pivotal bridge of the rebalanced European gas landscape.