By Akul RAIZADA, January 2026

India is pursuing a three-pronged LNG import strategy, with long-term contracts with Qatar serving as the anchor, US-indexed and portfolio contracts providing flexibility, and residual spot exposure offering optionality. While green hydrogen is expected to progressively replace grey hydrogen, significant gas displacement is not expected before 2035. For Europe, the impact is transmitted through supplier behaviour and contract mix rather than competition for spot or flexible cargoes. Global LNG suppliers increasingly view India as the growth hedge and Europe as the flexibility hedge, making India’s growing demand critical for portfolio optimisation.

India’s LNG use grows structurally while Europe’s demand shrinks

India is the fourth largest LNG importer globally and is on track to increase the share of natural gas in its primary energy mix from the current 6%-7% to 15% by 2030. This outlook is supported by IEA projections, which forecast a 60% rise in India’s gas demand by 2030, with LNG imports doing most of the heavy lifting as domestic production grows only modestly.

The fertilizer sector is currently the largest consumer of natural gas in India, followed by the City Gas Distribution (CGD) sector. The CGD sector is projected to emerge as the major demand driver, with consumption projected to grow 2.5 to 3.5 times by 2030.

Price sensitivity remains a structural feature of India’s LNG demand, as seen during the 2021-22 prices spikes, which resulted in significant demand destruction in the power and industrial sectors. This reinforces the need for more long-term and flexible supply. Developments in India are in sharp contrast to Europe, where IEEFA forecasts European LNG demand to peak by 2025 and decline through 2030.

India’s portfolio as a risk-management strategy

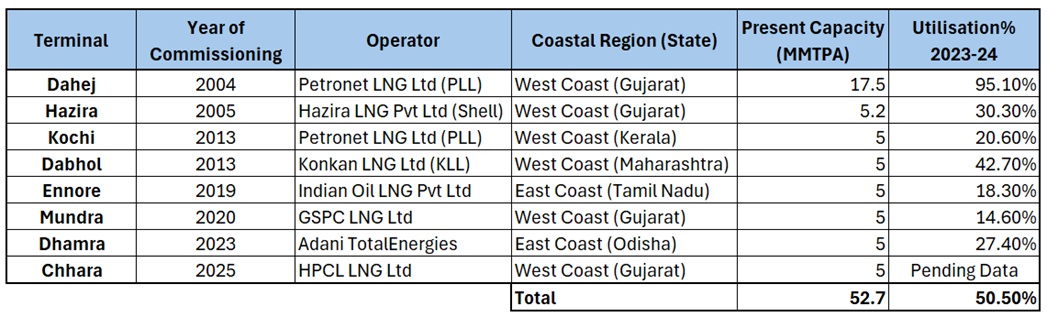

India’s LNG imports are expected to grow at a CAGR of around 10% with volumes growing from 26 mtpa in 2024 to 46 mtpa by 2030. This growth is supported by 8 LNG import terminals with a combined regasification capacity of 52.7 mtpa. Overall capacity utilisation remains fragmented, averaging around 50%, with Dahej ~95% in FY24.

Source: Petroleum and Natural Gas Regulatory Body, India.

Capacity expansion is under way, notably at Dahej (+5 mtpa) and new east-coast capacity (Gopalpur/Petronet LNG). This underscores that current and planned capacity overbuild should be considered as optional flexibility rather than a forecast of linear volume growth.

Qatar anchors India’s long-term LNG security, accounting for ~39% of LNG imports by volume and ~42% by value ($5.75 billion). This is underpinned by Qatar supplying 7.5 mtpa to Petronet under a contract originally signed in 1999 (FOB), which was renewed in 2024 for 20 years (2028-2048) on DES basis. In addition, Gas Authority of India Limited (GAIL) has a 5-year contract for 12 cargoes/yr starting 2025, equivalent to 0.72 mtpa, signed at a slope of 115% to Henry Hub plus a constant of $5.66/MMBtu.

US LNG serves as destination-flexible component, with imports doubling compared to 2022 and reaching a record high of 5.2 mtpa in 2024. GAIL holds long-term US contracts totalling 5.8 mtpa, split between Berkshire Hathaway Energy’s Cove Point plant and Cheniere Energy’s Sabine Pass site in Louisiana.

India is signalling a shift from pure offtake contracts to equity-linked security. In 2025, GAIL issued a tender to acquire up to 26% equity in a US LNG project, coupled with 1 mtpa of offtake for 15 years starting 2029-30. India is making concerted efforts to build a diversified portfolio to spread supplier and basin risk.

Indian hydrogen development as a leading indicator of post-2035 gas erosion

International stakeholders should view 2025-2030 as a “set-up” phase for India’s green hydrogen ambitions, with no significant decline in gas-demand. This perspective is particularly relevant as the National Green Hydrogen Mission’s (NGHM) objectives face real-world implementation challenges. NGHM aims to produce 5 mtpa green hydrogen by 2030, supported by an additional 125 GW renewable energy capacity and is expected to generate 600,000 jobs. However, the latest official guidance suggests 3 mtpa by 2030 is more realistic, pushing the original 5 mtpa target to 2032. This postponement reflects a domestic slowdown and growing premium fatigue among buyers in Europe and Japan as they recalibrate their hydrogen programs.

India’s total hydrogen consumption is expected to reach 11 mtpa by 2030, with grey hydrogen dominating. Refineries are the largest single user, followed by fertiliser production. While draft policies mandating minimum green hydrogen offtake in specific sectors have been under discussion since 2021, but they remain stalled at the draft stage.

Transmission Channels from India’s LNG & Hydrogen Moves to Europe’s Gas Outlook

As India continues to lock in substantial long-term volumes from Qatar and US, an increasingly smaller share of its demand growth will be met through spot cargoes. This limits the likelihood of direct head-to-head spot competition with Europe, especially as European LNG demand recedes. There are still possibilities of intersection during periods when weather or infrastructure shocks tighten market balances or during post-price spike rebounds in spot demand.

India is broadening the set of benchmarks influencing delivered prices by moving from pure oil-linked contracts to a mix of Brent-linked, Henry-Hub-linked and portfolio LNG. This will have two implications; first, India’s willingness to pay on spot will be influenced by a more diversified base price; second, the structure of future long-term contracts (LTCs) with Qatar and US suppliers, for both Europe and India, will reflect supplier strategies to balance portfolio risk across markets.

European gas markets should treat India’s hydrogen development as a leading indicator of post-2035 gas erosion, rather than a reason to recalibrate 2030 gas balances. Even if India reaches 3-5 Mt green hydrogen by early 2030s, this mainly reshapes feedstock gas demand rather than total gas demand and will take time to translate into lower LNG import needs.

Short-term (until 2028-30): Until new LNG capacity is fully online, there remains a risk of episodic price spikes when European storage needs intersect with Indian spot demand. However, India’s rising LTC coverage is likely to dampen its spot pull in these periods.

Medium-term (from 2030-32): As global supply expands and European demand declines, structural competition for cargoes eases. Pricing power shifts back to buyers, with Asian emerging markets led by India becoming the main growth anchor, while Europe remains a premium, but shrinking, sink.

Overall, India’s LNG portfolio evolution and early hydrogen shift are best seen as second-order drivers for Europe, shaping contract structures and supplier behaviour rather than primary determinants of Europe’s physical gas security.