Irina Mironova for CEDIGAZ

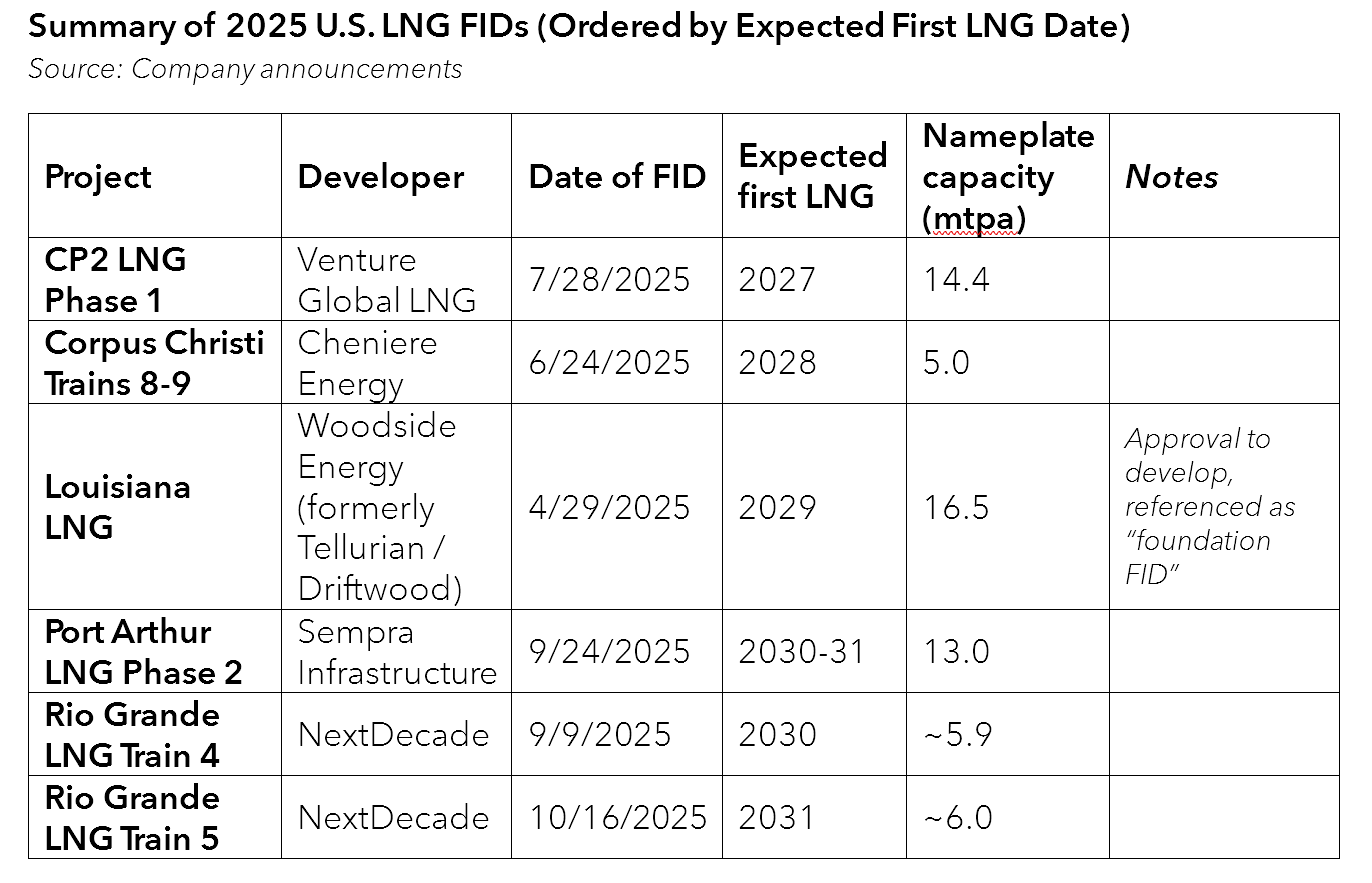

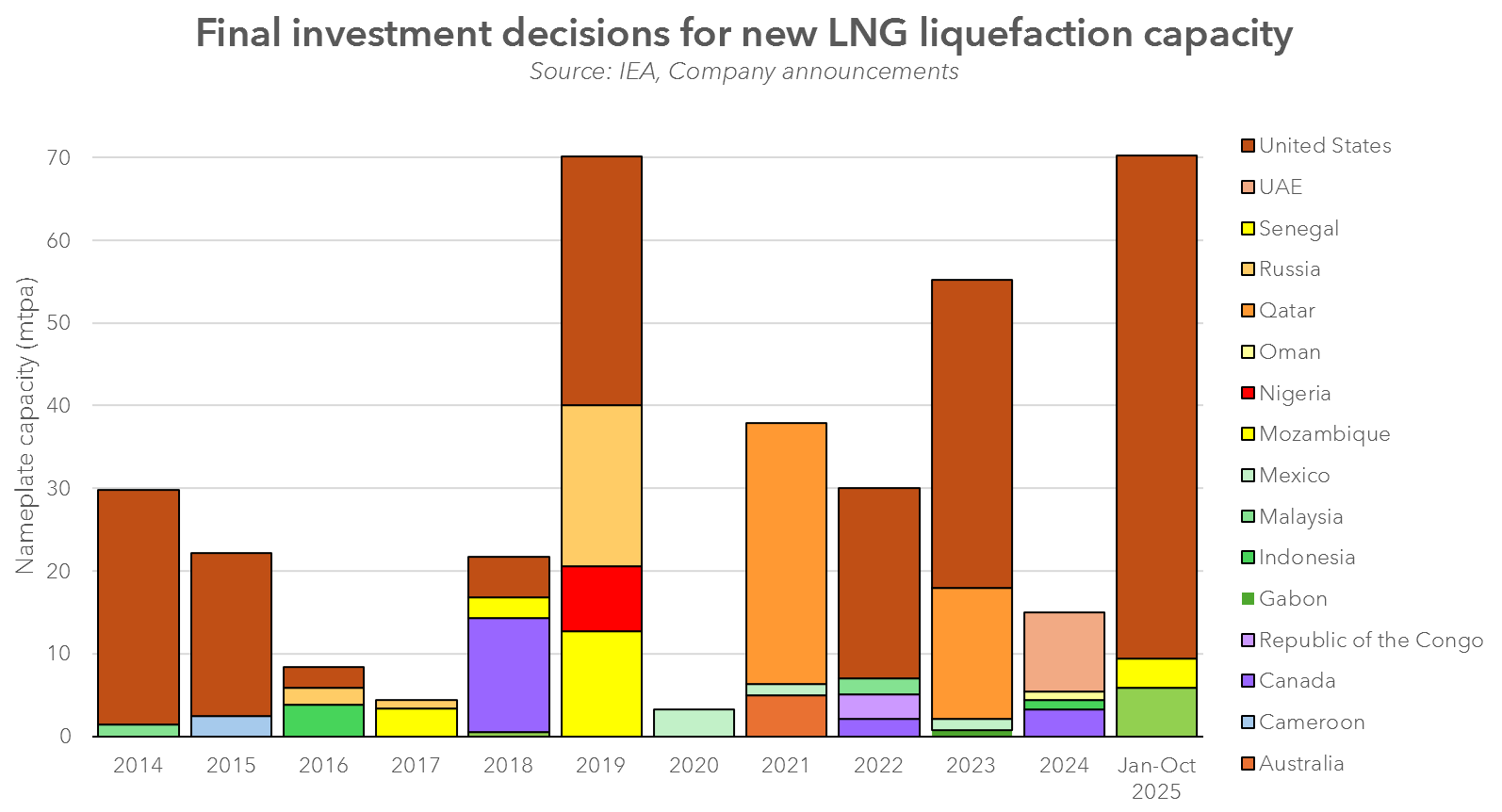

While 2025 has already seen a record-breaking 60+ Mtpa of U.S. LNG export capacity sanctioned through final investment decisions (FIDs), recent execution delays and contract disputes are revealing cracks in the U.S. LNG export model.

A series of major projects have advanced to FID in recent months (see Table). Yet, not all signals are bullish. Notably, Energy Transfer postponed its long-anticipated FID on Lake Charles LNG to Q1 2026, citing construction cost inflation and slower finalization of sales and purchase agreements (SPAs).

If all sanctioned and under-construction projects proceed as planned, the U.S. could control approximately one-third of global LNG supply by the 2030s. The recent greenlight for Rio Grande LNG Train 5, announced on October 16, brought 2025’s total to match the record FID pace of 2019.

However, this expansion also brings rising exposure to execution risks and buyer dissatisfaction.

The recent arbitration ruling in favor of BP against Venture Global LNG (VG) is a noteworthy moment in this context. In October 2025, an arbitration tribunal found VG in breach of its long-term SPA with BP, ruling it failed to declare commercial operation at its Calcasieu Pass terminal in a “reasonable and prudent” manner. BP is seeking over $1 billion in damages.

This case brings a new vibe to U.S. LNG exports. Historically seen as reliable, flexible, and buyer-friendly, U.S. LNG developers now face reputational risk. For long-term Asian and European buyers who ink 15–20 year SPAs based on start-date certainty and delivery assurance, the ruling is an important signal. This moment is a “risk check” on the U.S. LNG ascendancy: while the U.S. remains the dominant growth zone for LNG capacity, the BP‑VG arbitration introduces a supply‑risk dimension.

The key for traders, policymakers and investors will be watching how contract architecture, price setting and supply chain logistics evolve in response.

What to watch in 2026:

- Whether U.S. buyers renegotiate existing contracts or seek volume swap/alternative supplier deals.

- Whether U.S. project developers face higher financing cost due to perceived contractual risk.

- How contract pricing evolves: e.g., longer‑term U.S. SPAs may see stronger discounting or inclusion of flexibility clauses.

- Whether Asia‑Pacific and European buyers accelerate diversification away from U.S. supply and increase offtake from other sources.

Relevant recent developments

Chevron presses U.S. regulators over Venture Global Plaquemines LNG deadline

Chevron filed a motion with FERC to intervene in Venture Global’s request to delay the in-service date for Plaquemines LNG from Sept 2026 to Dec 2027. The move follows the BP arbitration ruling and reinforces growing buyer concern over delivery certainty. (Reuters (1), Reuters (2))

Sempra greenlights Port Arthur Phase 2 ($14B, 13 Mtpa)

FID secured with JERA, ConocoPhillips, EQT. COD expected 2030–31. This brings Port Arthur’s total to 26 Mtpa. (OGJ, Sempra, IEA, OilPrice, Reuters)

NextDecade sanctions Rio Grande Train 5 (6 Mtpa)

FID adds to ~30 Mtpa under construction. Notably, TotalEnergies declined to join this phase. COD expected H1 2031. (Reuters, LNG Industry)

The FID for Rio Grande Train 4 was taken earlier in September (Reuters).

Energy Transfer delays Lake Charles LNG FID to Q1 2026

Citing cost inflation and SPA delays, Energy Transfer moved its final investment decision to 2026. (Bloomberg, LNG Journal)

Waha Hub prices dip below zero amid pipeline outages

West Texas gas prices hit −$9.50/MMBtu due to takeaway constraints during major maintenance. Negative pricing may persist through October. (EIA, Energy Intelligence, Aegis Hedging)