Out of the 8.3 Mt of US LNG exports recorded in the first 8 months of 2017, 2.37 Mt was exported to the North East Asian countries (29%). This represents a remarkable development given the fact that the US did not send any cargo to North East Asia in 2016.

On average, US LNG has turned out to be the most expensive LNG supply source in the region, priced 18% above the average regional LNG import cost. However, a country by country analysis shows that the US LNG was indeed priced close to the average price of LNG imports for China and even lower for South Korea and Taiwan. Japan is the only country in the region which pays a price for US LNG well above both its average cost of imports ($12.26 vs $8.04, a 52% extra-cost) and regional spot price indexes.

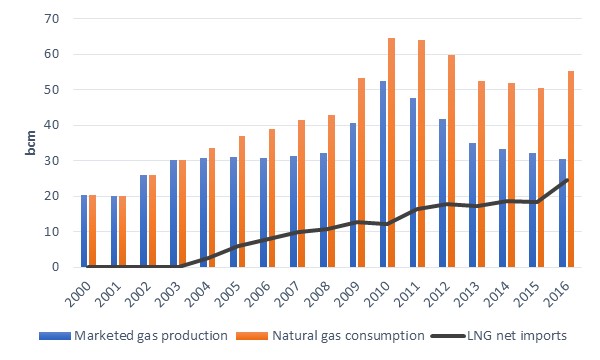

Source: CEDIGAZ

Source: CEDIGAZ