The International Association Cedigaz has just released its report “CHINA HYDROGEN ENERGY AND FUEL CELL INDUSTRY: ON THE CUSP OF A MAJOR BREAKOUT”, which assesses progress in the development of clean hydrogen and looks at China’s energy policy and industry efforts to make hydrogen a key driver of the energy transition.

ON THE CUSP OF A MAJOR BREAKOUT

Looking ahead, the Chinese hydrogen energy sector is on the cusp of a major breakout. In the context of the 14th Five-Year Plan (2021-2025), the central government is planning a new development path of the sector. The development of hydrogen energy is of great significance for China to achieve its energy transition, promote new industrial chains, and ensure the country’s energy independence. Draft policy documents consider the recognition of hydrogen as an energy source, the establishment of a national strategic plan and roadmap for the sector, and the set-up of rules, codes and standards for hydrogen energy.

Sources of hydrogen production from 2020 to 2050

Source: China Hydrogen Alliance

Although China is the world’s largest hydrogen producer, its production, mainly coming from the gasification of coal, is mostly used as feedstock for industry. There are only a few demonstration projects to produce green hydrogen, mainly related to the supply of clean energy for the Beijing 2022 Winter Olympics. Moreover, the development of blue hydrogen from coal with CCUS requires scale and cost reductions. There is still a technology gap between China and international advanced levels. Many Chinese manufacturers are developing fuel cell electric vehicles (FCEVs), but they rely on foreign stacks leading to higher costs. Moreover, standards for hydrogen energy have not been yet established.

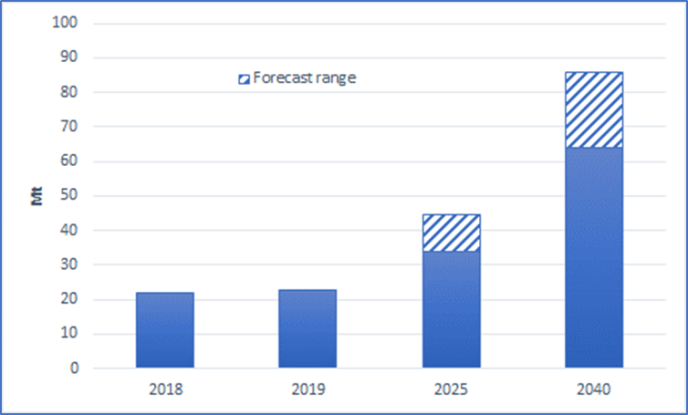

So, China needs to strengthen and coordinate R&D to achieve breakthroughs and cost reductions, and to master and localise FC core technologies and key components. China will also expand the field of hydrogen energy applications. According to the China Hydrogen Energy Alliance, by 2035, China’s hydrogen energy supply will reach 40 million tons, accounting for 6% of the final energy demand.

Although late in development compared to other nations, China’s hydrogen energy and FC industry is developing rapidly. Since March 2019, when, for the first time, hydrogen energy was included in the “Government Work Report”, local governments have successively issued hydrogen energy and FC industry plans and implemented support measures. More than 40 provincial and municipal governments across the country are building hydrogen cities today, hydrogen industrial parks and hydrogen valleys.

Used to be driven mostly by automakers and private companies, the hydrogen value chain has started to attract investment from state-owned enterprises. The sector has seen at least 49 investment, merger & acquisitions deals in 2019, exceeding $14 billion. China accounted for a quarter of the global FCEV market in 2019 and now, with more than 6,000 FCEVs on the road, has bypassed Japan and is just behind the US. China is now targeting to reach 10,000 vehicles by the end of 2020 and 1 million by 2030. Investment in hydrogen refuelling stations (HRS) has accelerated. At the end of 2019, China had 52 HRS in operation and aims to achieve the goal of 1,000 HRS by 2030.

China’s future hydrogen developments will have implications on the global energy, hydrogen and automotive industries.

By Sylvie Cornot-Gandolphe for CEDIGAZ