By Irina Mironova for Cedigaz

Recent months have seen extensive reporting on Russia’s oil “shadow fleet.” This prompted a parallel review of the LNG shipping segment: does a comparable structure exist in LNG, and what does the actual fleet engaged in transporting Russian LNG look like?

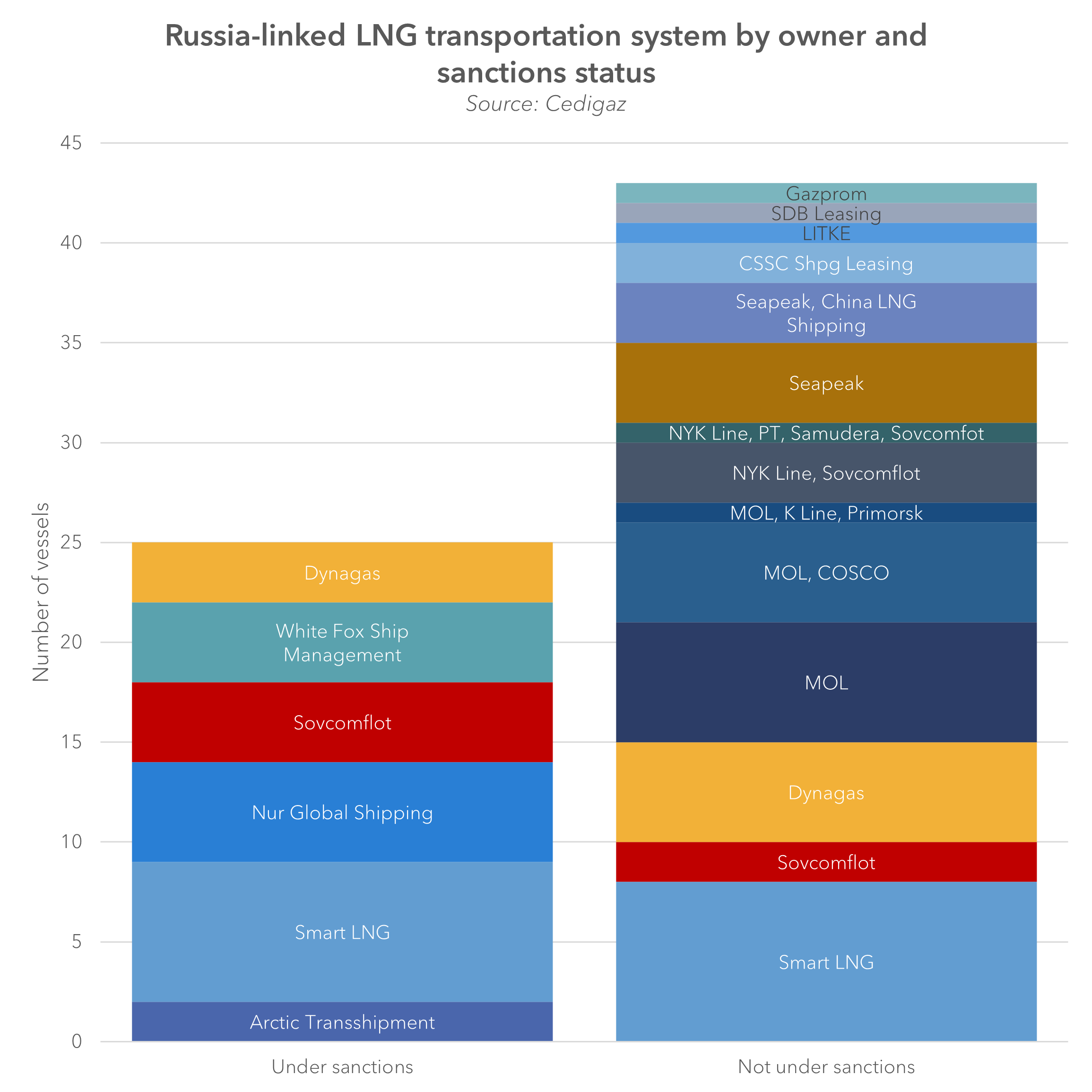

The result is a dedicated database compiled for Cedigaz subscribers, covering vessels directly or indirectly involved in transporting LNG from Yamal LNG, Sakhalin LNG and Arctic LNG-2, as well as vessels participating in transshipment operations.