Thanks to India’s rising economy and population, the country’s outlook for growth in energy demand is robust. The role of gas in the country’s energy mix, however, is hard to determine. Today, India’s primary energy mix is dominated by coal and oil. The role of natural gas is limited: only 6% in 2016. But the government wants to make India a gas-based economy and raise the share of natural gas in the energy mix to 15% by 2022, although the timing remains uncertain. This paper analyses gas demand trends in India by 2025-30 and draws on two reports recently published by the Oxford Institute for Energy Studies (OIES) and the Bureau of Economic Geology (BEG)/Centre for Energy Economics (CEE), University of Texas.

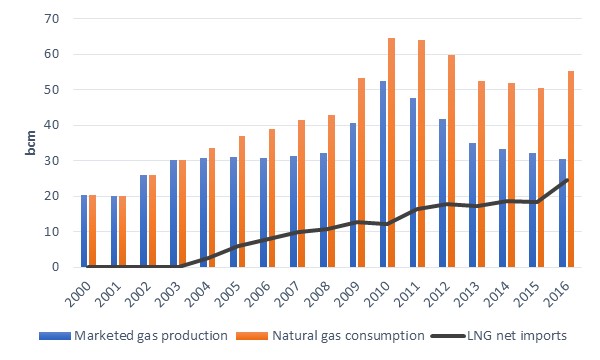

Natural gas production, consumption and LNG imports in India (2000-2016)

Source: CEDIGAZ

Source: CEDIGAZ