The EU gas and energy sector is in the midst of a profound transformation driven by decarbonisation, digitalisation and decentralisation. The latest report by Cedigaz analyses in ten key points the evolution of the gas sector and includes forward looking views on new trends in EU gas markets.

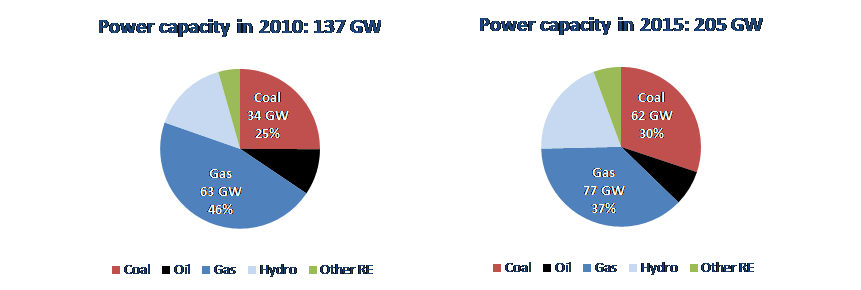

| 6. Role of gas in the energy transition in the medium term: Natural gas is expected to be a key pillar of the EU energy transition. As the cleanest of all fossil fuels, it allows a quick reduction of the power sector’s emissions thanks to coal-to-gas switching. Moreover, thanks to its flexibility, natural gas is an ideal partner to renewables. Gas-fired power plants are well suited to follow rapid swings in power supply of variable renewables. In the transport sector, the cleanliness of natural gas is a key advantage for improving air quality, a major health and economic issue. In maritime transport, new regulations to reduce sulphur emissions from shipping play a key role in the development of LNG as a marine fuel. Natural gas, if it cannot decarbonise the heating sector, can make an effective contribution to reducing emissions from the sector and, in the long term, can be replaced by renewable gas.

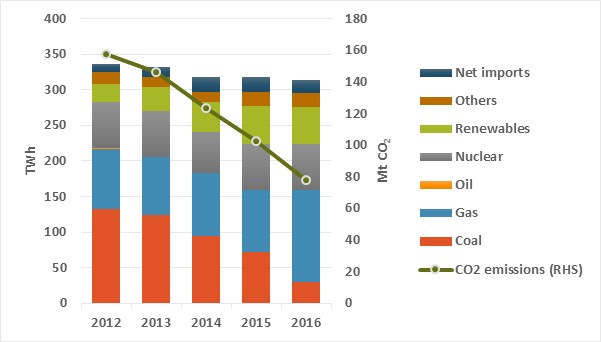

UK power supply & CO2 emissions from power plants

|