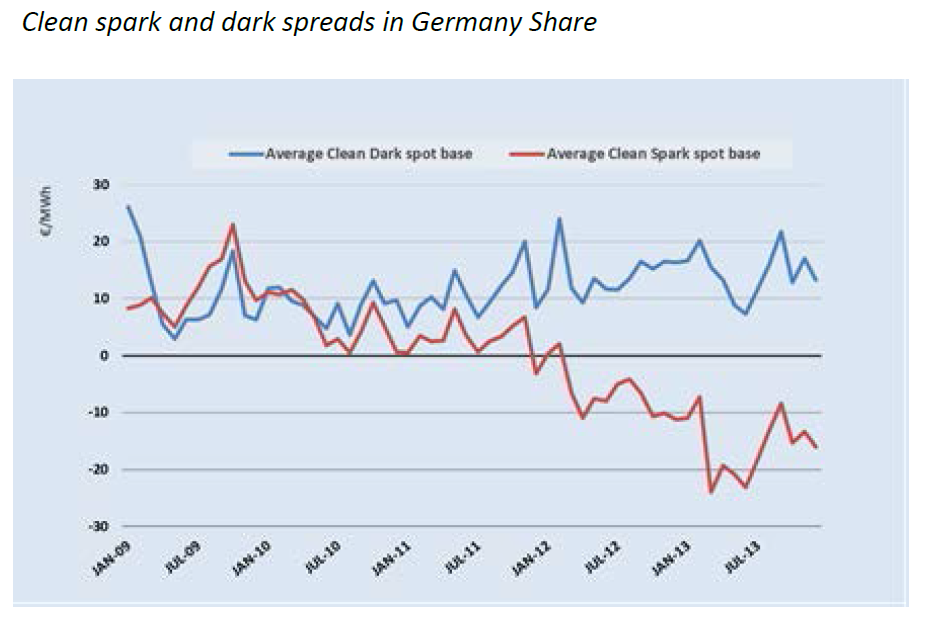

According to a new report by CEDIGAZ, the International Centre for Natural Gas Information, gas has lost its attractiveness against coal in the EU power sector. Its demand by the sector decreased by one third during the past three years and its prospects are very weak in this decade. The Association warns that unprofitability of CCGTs and the retirement of old coal plants due to stringent air regulation may lead to the closure of one third of the current fleet and poses a serious security of supply issue that has to be addressed urgently.

The European paradox: despite the numerous advantages of gas over coal, the evolution of gas, coal and CO2 prices dictates a preference for coal

A confluence of factors – including flat electricity demand, the fast development of renewable energy sources (RES), falling wholesale electricity prices, high gas prices relative to coal and low CO2 prices – has eroded the competitiveness of natural gas in the EU power sector. Gas demand lost 51 billion cubic meters in the past three years, the equivalent of the total annual demand on the French gas market. By contrast, coal-fired power stations operated at high loads, increasing coal demand by the sector by 10% between 2010 and 2012.

A confluence of factors – including flat electricity demand, the fast development of renewable energy sources (RES), falling wholesale electricity prices, high gas prices relative to coal and low CO2 prices – has eroded the competitiveness of natural gas in the EU power sector. Gas demand lost 51 billion cubic meters in the past three years, the equivalent of the total annual demand on the French gas market. By contrast, coal-fired power stations operated at high loads, increasing coal demand by the sector by 10% between 2010 and 2012.

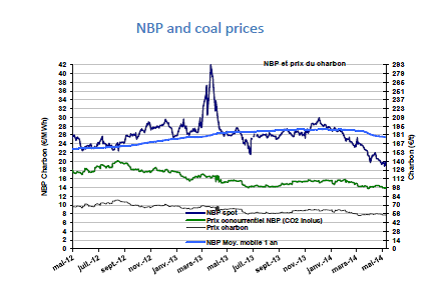

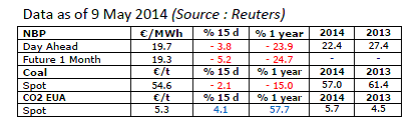

The relationship between coal, gas and CO2 prices is a key determinant of fuel switching and will remain so. A supply glut on the international coal market (partly because of an inflow of US coal displaced by shale gas) has led to a sharp decline in coal prices while gas prices, still linked to oil prices to a significant degree, increased by 42% between 2010 and 2013. The recent fall in gas prices (a decline of 29% for European spot prices in the first four months of 2014) does not fundamentally change the situation. As coal prices have also declined, coal is currently three times cheaper than natural gas on an energy equivalence basis. With a weak carbon price, coal is preferred to natural gas. Our analysis of future trends in coal, gas and CO2 prices suggests that coal competitive advantage may well persist into the coming decade unless structural reforms of the EU ETS allow an increase of CO2 prices.

National policies also play a key role in shaping the competition between gas and coal. The three largest EU coal consuming countries – Germany, Poland and the United Kingdom – have mixed approaches on the role of coal in their electricity mix. The analysis of their national energy policies clearly shows that the path to a low carbon economy can be achieved differently and at a different pace according to national specificities and trade-offs between the objectives of sustainability, competitiveness and security of supply. Countries with domestic reserves view coal as a means of increasing their security of energy supply especially in light of the current Russia-Ukraine crisis.