The ramp of new LNG production accelerated in 2016 when 16 million tons of new LNG supply were added to the market, representing a 6.8% annual growth. This was the highest growth rate recorded since 2011 but it only represents the very beginning of the LNG wave that is about to hit the market. There are still about 110 mmtpa of new capacity under construction that are expected to start producing from now to 2020-2021. This equates to around 42% of the 2016 LNG demand that would come on line in a very short time, raising the question of the capacity of the market to absorb the additional volumes and at what price.

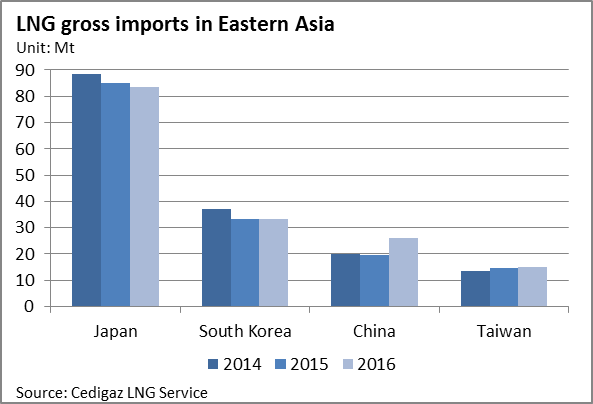

2015 saw the unexpected decline of LNG demand in Asia. This unsettling development had two main reasons. First the end of the Fukushima-driven growth in the JKT countries, especially in Japan, together with energy conservation policies led to a strong decline of LNG demand in the historical Asian markets. Second the collapse of Chinese LNG demand growth due to price issues and the competition with piped gas. On the bright side, 2015 witnessed the emergence of new buyers (Egypt, Jordan and Pakistan) – that were able to take advantage of the low price environment, thanks to the flexibility offered by FSRUs -, as well as accelerated growth in the MENA region.