ORDER BEFORE APRIL 30, 2015 AND GET A 20% DISCOUNT ON BASE PRICE

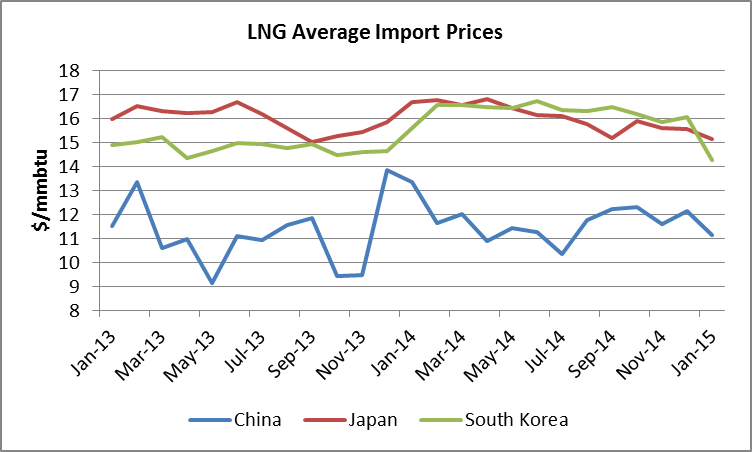

The LNG Service provides the LNG analyst with all the data needed to follow the developments of the fast moving LNG market. The LNG Service includes comprehensive, quarterly updated, worldwide databases on liquefaction projects, regasification projects, long-term gas supply contracts and LNG trade between countries, as well as monthly bulletins on traded volumes and prices. The company reports allow for easy assessment and benchmarking of the main players in the market and the CEDIGAZ LNG Outlook provides CEDIGAZ’s views on medium and long-term LNG market perspectives.

THE DATABASES

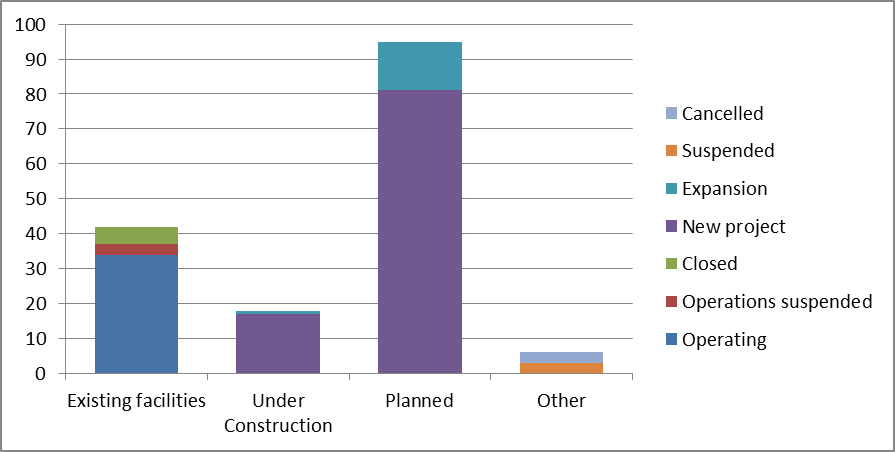

Liquefaction plants: CEDIGAZ has identified 132 projects (not including project closed, suspended or canceled) representing over 1,300 mtpa of potential liquefaction capacity, of which 34 operating projects (287.37 mtpa), 17 projects under construction – plus one expansion project – with expected start-up dates from now to 2018 (133 mtpa) and 81 projects – plus 14 expansion projects – at different stages of planning (880 mtpa).

Liquefaction plants: CEDIGAZ has identified 132 projects (not including project closed, suspended or canceled) representing over 1,300 mtpa of potential liquefaction capacity, of which 34 operating projects (287.37 mtpa), 17 projects under construction – plus one expansion project – with expected start-up dates from now to 2018 (133 mtpa) and 81 projects – plus 14 expansion projects – at different stages of planning (880 mtpa).

>>> Special features: quarterly updated,train level details, a dedicated spreadsheet allows the user to follow the authorization process for US and Canadian plants, historical production by plant.