CEDIGAZ, the International Association for Natural Gas Information, has just released its « Medium and Long Term Natural Gas Outlook 2016 ». This scenario, which incorporates key objectives of current and also planned national energy policies, highlights the growing role of natural gas as a bridge fuel towards a long-term increasingly renewable-based, efficient and sustainable energy system. Given the vast low-cost coal resources, the future expansion of natural gas in the global energy mix will be driven by the implementation of energy and environmental policies aiming to shift away from coal and oil to cleaner fuels within the context of a gradually decarbonising electricity system. In this scenario, the future global natural gas expansion is supported by strong supply growth, particularly of unconventional gas and LNG, in a context of rising prices as energy markets re-balance. CEDIGAZ Scenario’s trajectory is on a 3°C path, with energy-related CO2 emissions increasing by 0.3%/year on average, reaching almost 35 Gt over the 2030-2035 period.

Energy Transition - Page 4

With the first deliveries of Liquefied Natural Gas (LNG) from the US, let’s take a look at the fast changing energy landscape

US shale gas: the first of five revolutions at the beginning of the XXI century

Three revolutions on the supply side: US shale gas, US shale oil and worldwide renewable

The US shale gas revolution is only the first (and most documented) of three revolutions that happened since the beginning of this century on the supply side. The world has changed thanks to the US shale revolutions (gas first and then oil) and a global quest for renewable. Those revolutions took over a decade but will shape the XXI century. Australia followed producing unconventional gas and is now also exporting it. It should take some time for unconventional oil and gas production to materialize in other places where the resource is available[1] (Argentina, Canada, China, Mexico, Russia, South Africa, etc.) but the US shale revolutions should be exported in a few other countries.

LNG IN TRANSPORTATION (October 2014)

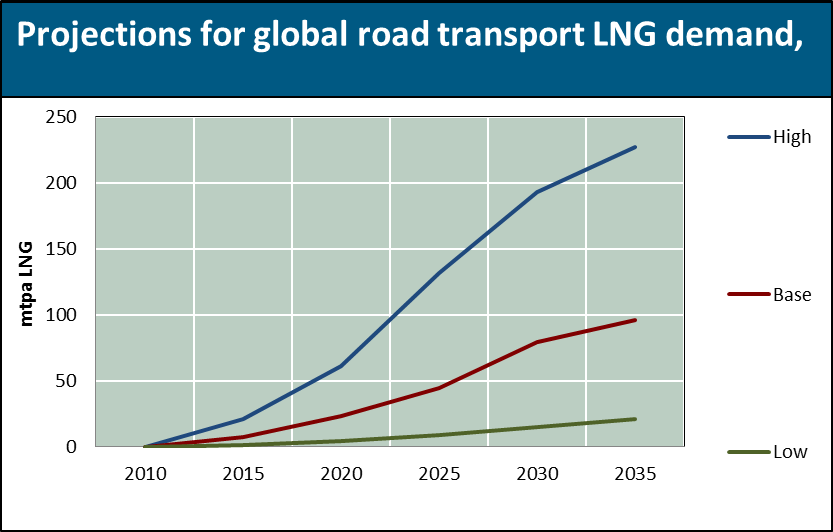

According to a new report by CEDIGAZ, the International Center for Natural Gas Information, LNG as a fuel will capture a significant market share in the transport sector by 2035. The greatest potential is seen in road transport, were annual demand is projected to reach 96 million tons per year (mtpa) in CEDIGAZ’ base scenario while demand in the marine sector could grow to an estimated 77 mtpa. The rail sector could add another 6 mtpa to global demand. However, the development of LNG as a transport fuel faces a number of challenges, and will have to go hand in hand with the development of fuelling infrastructure.

Fuel cost differentials will drive the growth in trucking sector

Use of LNG in land transport will be largely limited to heavy duty vehicles (HDV) and will essentially be driven by the difference between the price of diesel and that of LNG. In contrast with the marine sector, environmental legislation is unlikely to play a major role in triggering the adoption of LNG as a fuel for land transportation, as traditional fuels and technologies will be able to comply with the gradual tightening of emissions standards. However, the cost advantage of LNG relative to diesel currently provides a strong economic incentive in the trucking industry. In its base scenario, CEDIGAZ projects a worldwide demand of 45 mtpa in 2025 growing to 96 mtpa in 2035, with China representing almost half the global market. China has several features that combine to make it a prime candidate for the development of LNG in the road sector. The country has the world’s largest inland goods transport market and has already developed an extensive LNG supply infrastructure, initially as a means of transporting gas from remote fields or to consumers who were not connected to the pipeline supply network. With at least 100,000 LNG vehicles and 1,100 refuelling stations at the end of 2013, China already has a head start over the rest of the world in this nascent market. However, gas price reform in China may slow LNG growth there. LNG should also carve out a significant market share in the US, Europe and the rest of Asia.

Use of LNG in land transport will be largely limited to heavy duty vehicles (HDV) and will essentially be driven by the difference between the price of diesel and that of LNG. In contrast with the marine sector, environmental legislation is unlikely to play a major role in triggering the adoption of LNG as a fuel for land transportation, as traditional fuels and technologies will be able to comply with the gradual tightening of emissions standards. However, the cost advantage of LNG relative to diesel currently provides a strong economic incentive in the trucking industry. In its base scenario, CEDIGAZ projects a worldwide demand of 45 mtpa in 2025 growing to 96 mtpa in 2035, with China representing almost half the global market. China has several features that combine to make it a prime candidate for the development of LNG in the road sector. The country has the world’s largest inland goods transport market and has already developed an extensive LNG supply infrastructure, initially as a means of transporting gas from remote fields or to consumers who were not connected to the pipeline supply network. With at least 100,000 LNG vehicles and 1,100 refuelling stations at the end of 2013, China already has a head start over the rest of the world in this nascent market. However, gas price reform in China may slow LNG growth there. LNG should also carve out a significant market share in the US, Europe and the rest of Asia.