NBP: down in August and September, up in October

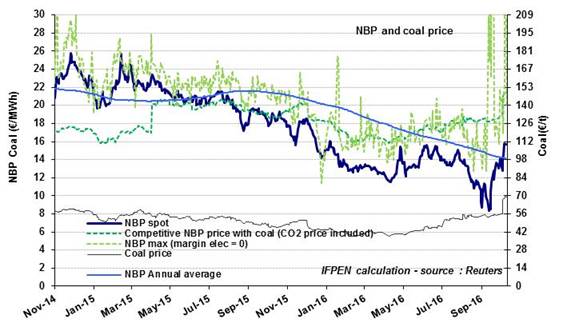

The slight pressure on the NBP price in the month of June has turned out to be transient, due to temporary supply constraints. Since then, it has fallen steadily, losing nearly 6% in July, 13% in August and another 6% in September. The September average was €11.4/MWh ($3.7/MBtu) compared to €14.8/MWh ($4.9/MBtu) in June, a drop of 23%.

The slight pressure on the NBP price in the month of June has turned out to be transient, due to temporary supply constraints. Since then, it has fallen steadily, losing nearly 6% in July, 13% in August and another 6% in September. The September average was €11.4/MWh ($3.7/MBtu) compared to €14.8/MWh ($4.9/MBtu) in June, a drop of 23%.

September saw strong volatility in the NBP price. Early in the month, it stayed within an extremely low range (€8.3 to 11.3/MWh), subject to significant variations in supply and demand. This temporary weakness in the price also reflected that the Interconnector was saturated during this period, preventing the export of surplus gas to the Continent. The NBP, tending to trend upward since September 14, remained very volatile at €12 to 14/MWh ($3.9 to 4.6/MBtu).