Brent: Expected to fall in 2015

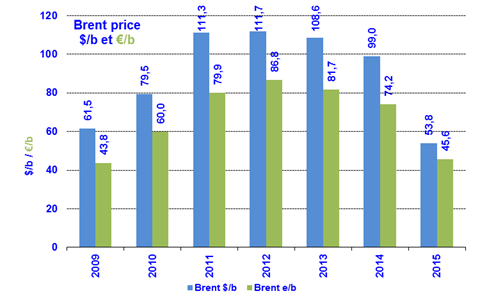

In 2014, the Brent price stood at $99/b, down by nearly $10/b compared to 2013 ($108.6). Of course, the major event of the year was the Brent’s plunge from $112/b in June to $62/b in December. The trend continued in January 2015: the Brent lost another $10 and reached $45/b. The reason for this downswing, over and above flagging economic growth and the dollar’s progression since June (-12% for the euro, worth $1.18 in January), is OPEC’s decision on November 27 to abandon the role of swing producer. OPEC aims to get producers of non-OPEC oil, LTO and high-cost unconventional oil to slow their increase in output to avoid a steady erosion of OPEC’s market share.

In 2014, the Brent price stood at $99/b, down by nearly $10/b compared to 2013 ($108.6). Of course, the major event of the year was the Brent’s plunge from $112/b in June to $62/b in December. The trend continued in January 2015: the Brent lost another $10 and reached $45/b. The reason for this downswing, over and above flagging economic growth and the dollar’s progression since June (-12% for the euro, worth $1.18 in January), is OPEC’s decision on November 27 to abandon the role of swing producer. OPEC aims to get producers of non-OPEC oil, LTO and high-cost unconventional oil to slow their increase in output to avoid a steady erosion of OPEC’s market share.