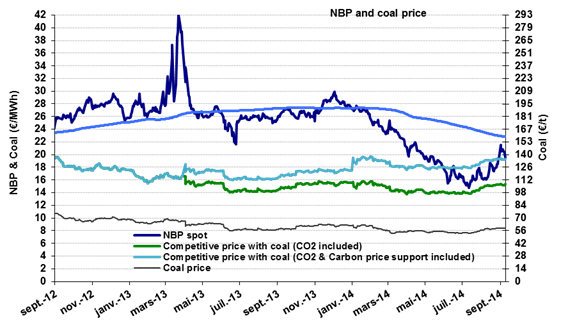

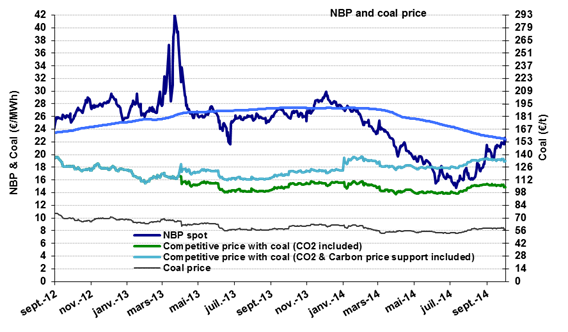

NBP: An uptrend with fluctuations

The NBP price continued its upswing, which began in July. In early October, it stood at €22/MWh ($8.1/MBtu), up from €20.9/MWh ($7.7/MBtu) in September (+20% compared to August). The price for the upcoming winter months is expected to be €25-26/MWh ($9.2-9.6/MBtu), slightly lower than anticipated a month ago. But the market is relatively nervous, as evidenced by the sudden spike of 4.6% on October 1 followed by a drop on the same order of magnitude two days later. These fluctuations reflect uncertainty about demand (due to the temperature) and the tensions surrounding the negotiations between Russia and Ukraine (the Russian proposal: 5 Gm3 over the winter at $385/1000 m3, i.e. $10.2/MBtu). The spike on October 1 thus coincides with the announcement that Russian gas deliveries to Slovakia will be halved.

The NBP price continued its upswing, which began in July. In early October, it stood at €22/MWh ($8.1/MBtu), up from €20.9/MWh ($7.7/MBtu) in September (+20% compared to August). The price for the upcoming winter months is expected to be €25-26/MWh ($9.2-9.6/MBtu), slightly lower than anticipated a month ago. But the market is relatively nervous, as evidenced by the sudden spike of 4.6% on October 1 followed by a drop on the same order of magnitude two days later. These fluctuations reflect uncertainty about demand (due to the temperature) and the tensions surrounding the negotiations between Russia and Ukraine (the Russian proposal: 5 Gm3 over the winter at $385/1000 m3, i.e. $10.2/MBtu). The spike on October 1 thus coincides with the announcement that Russian gas deliveries to Slovakia will be halved.