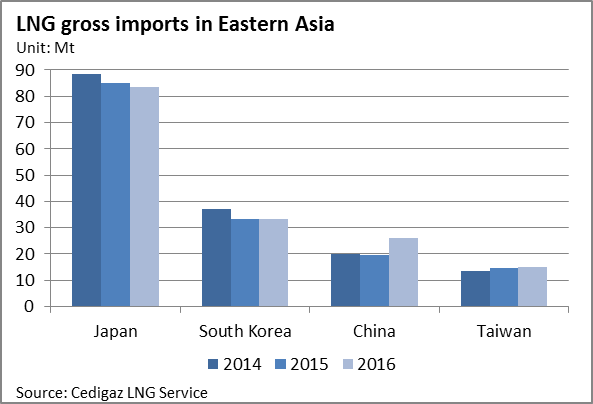

LNG imports in Japan, South Korea, China and Taiwan reached a total of 157.9 Mt in 2016, increasing by 3.4% compared to 2015 (152.7 Mt). This growth came mainly from China where imports surged by 33% year-on-year and to a lesser extent from Taiwan (+2.7%). In the meantime, imports of the world’s two largest consumers of LNG – Japan and South Korea – changed by -2% and +0.2%, respectively.

LNG imports in Japan, South Korea, China and Taiwan reached a total of 157.9 Mt in 2016, increasing by 3.4% compared to 2015 (152.7 Mt). This growth came mainly from China where imports surged by 33% year-on-year and to a lesser extent from Taiwan (+2.7%). In the meantime, imports of the world’s two largest consumers of LNG – Japan and South Korea – changed by -2% and +0.2%, respectively.

News - Page 6

Latest developments of the Egyptian gas industry

Egyptian marketed natural gas production has been steadily declining since 2009, as a result of the depletion of offshore mature gas fields and delays in new offshore developments (West Nile Delta), exacerbated by the political unrest. This downturn accelerated in 2013 (- 6%) and even further in 2014 (- 14%). In 2015, marketed production is estimated down 8.9% to 44.5 bcm, according to Cedigaz provisional estimates.

In a context of production shortfall, natural gas consumption declined from 52 bcm in 2013 to 48 bcm in 2014. In 2015, natural gas consumption stabilized despite the production decline as Egypt started importing gas after soaring power demand forced it to halt LNG exports.

TOUGH TIMES FOR FLNG PROJECTS Q2 2016 UPDATE OF CEDIGAZ’LNG DATABASE

Cedigaz is pleased to announce the release of the latest update of its LNG databases on Liquefaction plants, Regasification terminals and Long-term contracts have been updated. You will find below a summary of the most important developments that were included in the databases in Q1 2016.

Liquefaction projects:

The most significant event in Q1 2016, is indisputably the shipment of the first US LNG cargo from Cheniere’s Sabine Pass project in February. In Australia, Chevron started producing LNG and condensate at its 15.6 Mmtpa Gorgon LNG project. The first shipment of LNG has left Barrow Island, bound for Japan. The two additional 5.2 Mmtpa trains will be progressively commissioned throughout 2016-2017. In Indonesia, the startup of the Sengkang LNG project has been pushed back by one year and we now expect it to start commercial production in 2017. Depressed prices have continued to weigh on project development. In Australia, Woodside decided to freeze the Browse FLNG project. In Indonesia, the Abadi project, another large FLNG, was postponed and will be probably be redesigned as an onshore project. In Colombia, financially embattled PEP has canceled its FLNG project and in Canada, Altagas has announced the postponement of the Douglas Channel LNG projects in Canada.