CEDIGAZ, the International Information Center on Natural Gas, has just released its « Medium and Long Term Natural Gas Outlook 2019 ». Cedigaz Scenario incorporates government ambitions in the context of the energy transition that is underway. It is built upon the implementation of strong energy efficiency programmes and increased diversification of the energy mix based on the NDCs. Cedigaz Outlook 2019 highlights that natural gas has a crucial role to play to support the energy transition and meet all targets of the NDCs. However, this will not be enough to reach the +2°C target: emissions in the Cedigaz scenario would put the world closer to a +3°C path. The future expansion of natural gas in the energy mix is driven by the competitiveness and abundance of gas resources in gas-rich markets (North America, Russia, Middle East, Mozambique), which will expand LNG export capabilities. Positive developments of unconventional gas, especially in the US, and liquefied natural gas markets will continue to reshape natural gas supplies.

Outlook - Page 2

GLOBAL NATURAL GAS DEMAND GROWS BY 1.4%/YEAR BETWEEN 2016 AND 2040, WITH CHINA LEADING THE GROWTH

CEDIGAZ, the International Association for Natural Gas, has just released its « Medium and Long Term Natural Gas Outlook 2018 ». In CEDIGAZ Reference Scenario, which incorporates national energy plans and INDC commitments, natural gas demand will grow by 1.4%/year between 2016 and 2040 and will play a growing role in the energy mix at the expense of the other fossil fuels. The gradual shift from coal and oil to natural gas and renewables helps reduce the carbon intensity of the energy system as electrification and decarbonisation accelerate over the projection period. The expansion of natural gas markets is supported by both abundant and competitive conventional and unconventional resources, as well as a very rapid growth of spot and flexible LNG trade.

CEDIGAZ 2035 LNG Outlook – New projects needed after 2023

GLOBAL OVERVIEW

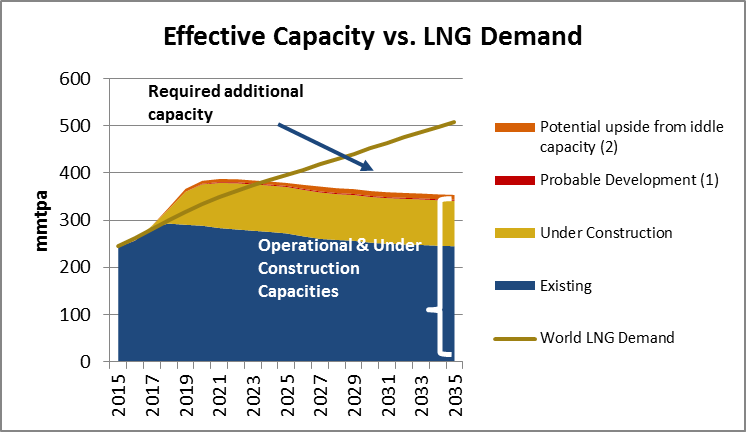

- Total effective capacity[1] is expected to increase significantly from 244 mmtpa in 2015 to 387 mmtpa in 2021 (+60%). Subsequently, effective capacity from facilities currently operational or under-construction should progressively decrease to reach 354 mmtpa by 2035 due to the aging of some assets and gas shortages in some producing countries. Demand will struggle to keep up with supply ramp-up at the beginning of the projection period and an over-supply situation should prevail. Rebalancing of the market is not expected before 2023, or even 2024 if probable developments (Fortuna FLNG) and potential upside from currently idle capacity (Egypt, Yemen) are taken into account. After that, the continuous growth of the LNG market will leave a large margin for the implementation of new projects.

Effective Capacity vs LNG demand

(1): Equatorial Guine (2): Egypt, Yemen

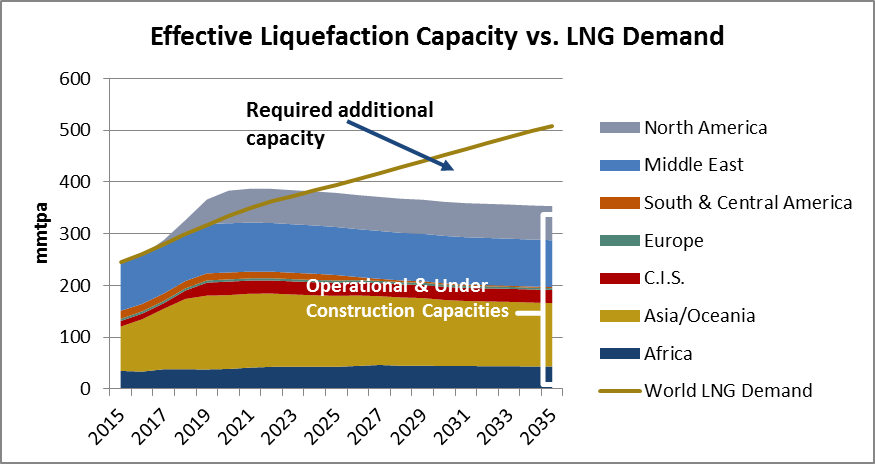

- Three main regions stand out: Asia-Oceania, the Middle East and North America. Effective liquefaction capacity in Asia-Oceania is expected to see a significant increase reaching a plateau between 2019 and 2023 and then decreasing until 2035. Capacity in the Middle East remains broadly stable throughout the period with just over 90 mmtpa of effective liquefaction capacity, although Qatar’s recent announcement calling for a 30% production growth to 2024 could change the game. In North America the stepping up of United States’ LNG will constitute a major upheaval, with a total liquefaction capacity expected to reach 66 mmtpa by 2021 (Canada included).

- LNG capacity in Africa and the CIS should remain stable after a slight increase at the beginning of the projection period. Stability is also expected in Europe, while effective capacity will gradually decrease in South & Central America due to growing constraints on feedstock as Trinidad and Tobago’s gas reserves dwindle.

Effective liquefaction Capacity vs LNG demand by region