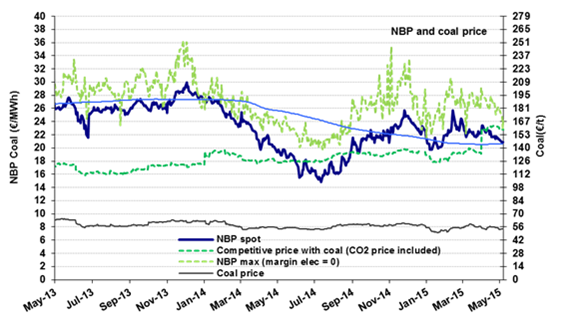

NBP: a significant decrease

The average NBP price fell by 5.5% in May to €20.9/MWh ($6.8/MBtu). So far, the overall downtrend observed since mid-February has not been as steep as it was last year. In May 2014, the price average stood at €19/MWh ($7.6/MBtu), i.e. 10% lower than in May 2015.

The average NBP price fell by 5.5% in May to €20.9/MWh ($6.8/MBtu). So far, the overall downtrend observed since mid-February has not been as steep as it was last year. In May 2014, the price average stood at €19/MWh ($7.6/MBtu), i.e. 10% lower than in May 2015.

Nor are forward markets anticipating a downtrend for the next few months as sharp as that occurring in 2014, with the NBP falling below €17/MWh ($6.8/MBtu) between June and August. The forecast is that prices will slip to €19.8/MWh ($6.6/MBtu) during the summer.