CEDIGAZ, has released today the sixth edition of its reference report on Underground Gas Storage. This updated edition entitled “The Underground Gas Storage & LNG Storage Market in the World 2015-2035” includes for the first time the coverage of LNG storage activity worldwide. The report includes detailed analyses of the latest developments and trends in the storage industry, CEDIGAZ’s Outlook to 2035 at regional and global levels, and extensive country analyses with complete datasets including current, under construction and planned UGS and LNG facilities for more 49 countries.

KEY FINDINGS INCLUDE:

€100 billion to €170 billion Investment Needed in Underground Gas Storage to 2035

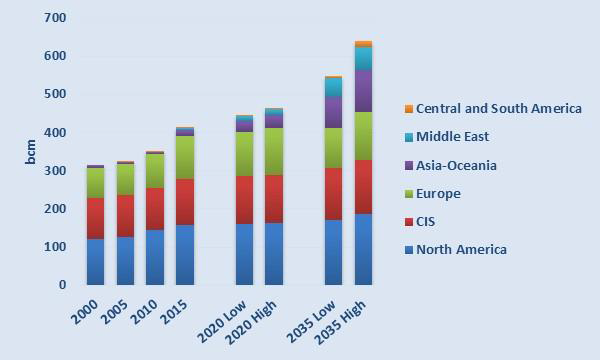

Global UGS capacity is expected to increase from 413 bcm in 2015 to between 547 and 640 bcm in 2035. This wide range reflects the uncertainties surrounding the evolution of global gas markets plus the uncertainties specific to the gas storage business, such as challenging geology or the competition from other sources of flexibility. New storage markets, Asia-Oceania, the Middle East, and potentially Central and South America are expected to drive the growth. Conversely, the growth in working capacity should be limited in mature markets, and could even be negative in the EU.

Global UGS capacity is expected to increase from 413 bcm in 2015 to between 547 and 640 bcm in 2035. This wide range reflects the uncertainties surrounding the evolution of global gas markets plus the uncertainties specific to the gas storage business, such as challenging geology or the competition from other sources of flexibility. New storage markets, Asia-Oceania, the Middle East, and potentially Central and South America are expected to drive the growth. Conversely, the growth in working capacity should be limited in mature markets, and could even be negative in the EU.