In 2014, the purchase of Repsol’s LNG assets in Peru and Trinidad and Tobago brought Shell an additional 4.3 mmtpa in liquefaction capacity and strengthened its global leadership in the LNG upstream sector. With the $70 billion takeover of BG, the Anglo-Dutch major is about to become the unquestionable leader, thanks to the world’s largest and most diverse portfolio. BG’s contracts will provide the company with an unprecedented coverage of global markets, but Shell has to keep developing LNG projects, as the medium- and long-term production of BG’s assets is uncertain.

Analysis - Page 8

Russian Gas Market: Entering New Era

After a period of extensive growth in the 2000s, the Russian gas industry is now facing numerous challenges. Mounting competition by independent producers and the development of new production by Gazprom, combined with stagnating domestic demand and weakening export markets, have created a situation of overproduction, made worse by western sanctions and low oil and gas prices. Expansion to the East thanks to the recent China deal is not expected to provide much relief before 2024. The coming decade will be critical for the industry and its outcome will largely depend on the government’s pricing and institutional policies but the role of the state should remain essential.

The New CEDIGAZ report “Russian Gas Market: Entering New Era” by Tatiana Mitrova (Russian Academy of Sciences) and Gergely Molnar analyses the ongoing changes in the Russian industry and the challenges to be met.

MEDIUM AND LONG TERM NATURAL GAS OUTLOOK

Natural gas will play a growing contribution in both OECD and emerging markets to meet the economic, environmental and security challenges of the world energy system. However, the future expansion of natural gas should not be taken for granted. Increased competition with coal in the power sector will need to be addressed while maintaining a gas price at a level compatible with the development of large capital-intensive projects. Only by resolving this conundrum can natural gas fully live up to expectations.

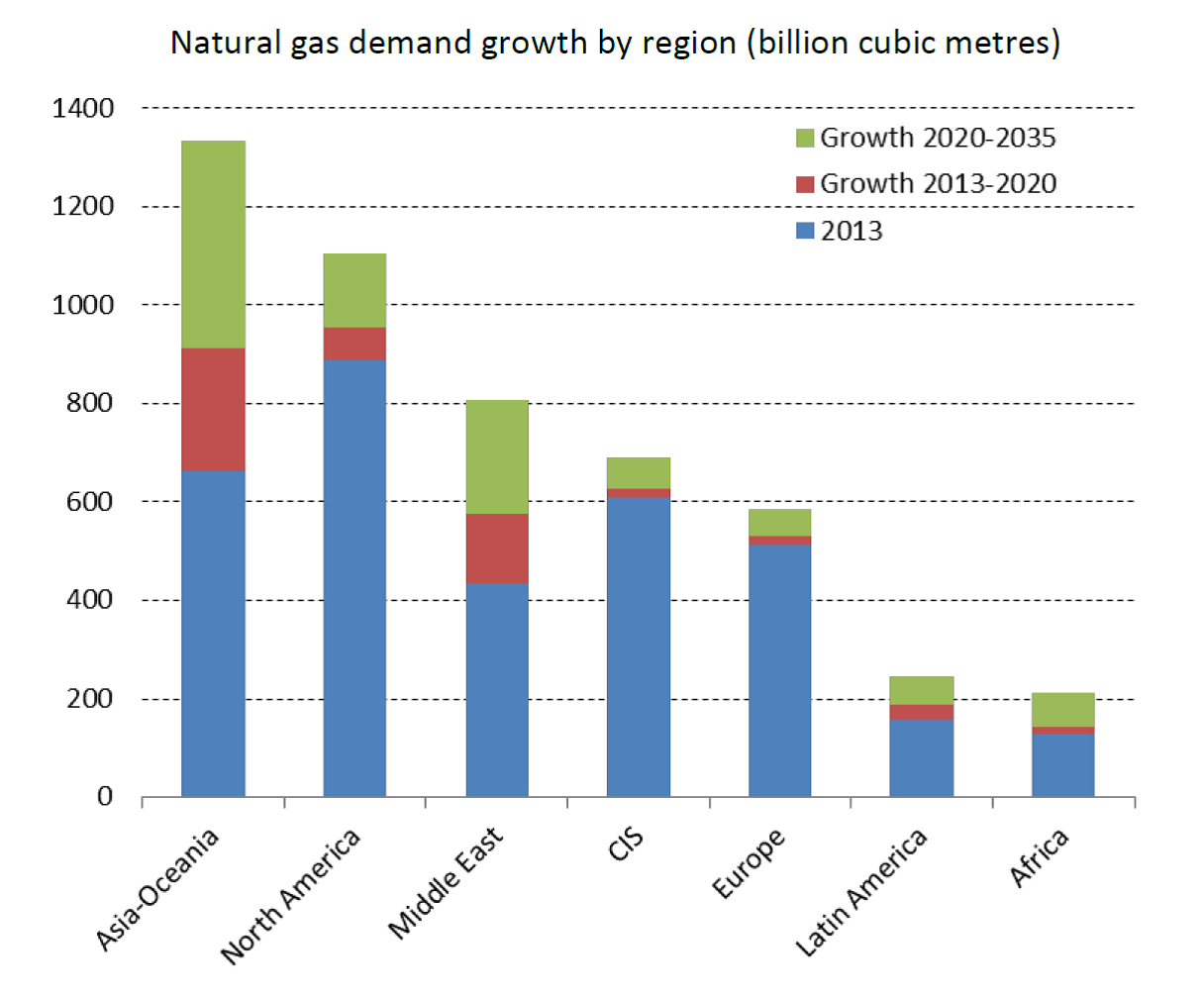

Gas demand growth is expected to remain strong to 2035, under the impulsion of the Middle East and China, where natural gas is making inroads in all consuming sectors

➢ Energy efficiency gains will slow down both global primary energy and gas demand growths relative to the previous decade

➢ Energy efficiency gains will slow down both global primary energy and gas demand growths relative to the previous decade

➢ Global primary energy demand will grow by 1.3% per year and natural gas demand by 1.8% per year to 2035. Natural gas will increase its share in the global energy mix from 21% in 2013 to near 24%

in 2035

➢ Approximately 75% of the projected growth will come from emerging markets, driven by the economic growth and the displacement of oil in every main consuming sector

➢ Natural gas should also expand in the power sector – and, to a lesser extent, in the transportation sector – in OECD countries under the incentive of environmental & climate policies

➢ Asia-Oceania and the Middle-East will drive demand, accounting respectively for 42% and 24% of global growth. Asia-Oceania will become the largest consuming area post-2020, led by China.

➢ In China, the future growth of natural gas will be driven by the implementation of an energy and environmental policy aiming to shift away from coal to cleaner fuels in the long term