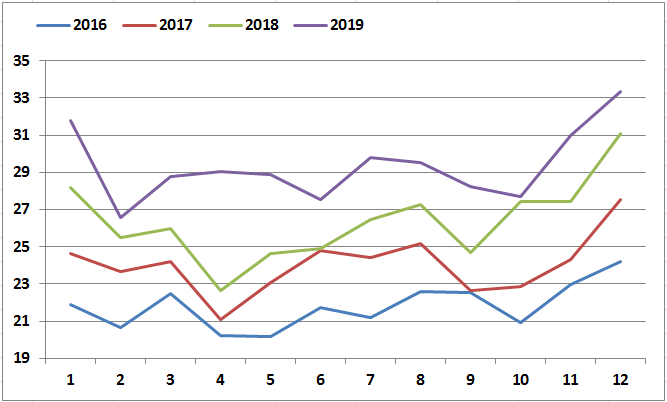

The LNG market grew strongly in 2019. Global Imports (net of re-exports and domestic shipment, Fig_1&2) were up by 12.2% to reach 350.5 Mt (+38 Mt Y-o-Y) driven by the arrival of abundant LNG supply. In a context of weak growth in Asia (+5 Mt Y-O-Y compared to +27 Mt Y-o-Y in 2018) , which had been the driving force in previous years, Europe absorbed the bulk of the new volumes (+37 Mt), acting as a market of last resort. In all other regions, combined net imports’ decline was -4 Mt (Includes -2.3 Mt from Egypt in North Africa as it ceased LNG imports). As the growth in LNG supply outpaced demand, prices plummeted, reinforcing the competitiveness of gas in Europe.

Figure_1: Monthly Evolution of LNG Trade Y-O-Y (Mt)

Source: Cedigaz