This blog post analyses the main findings of the LNG Monthly Bulletin. The LNG Monthly Bulletin provides monthly traded volumes and prices by importer and country of origin, it is part of the LNG Service by Cedigaz.

Asian LNG market is easing

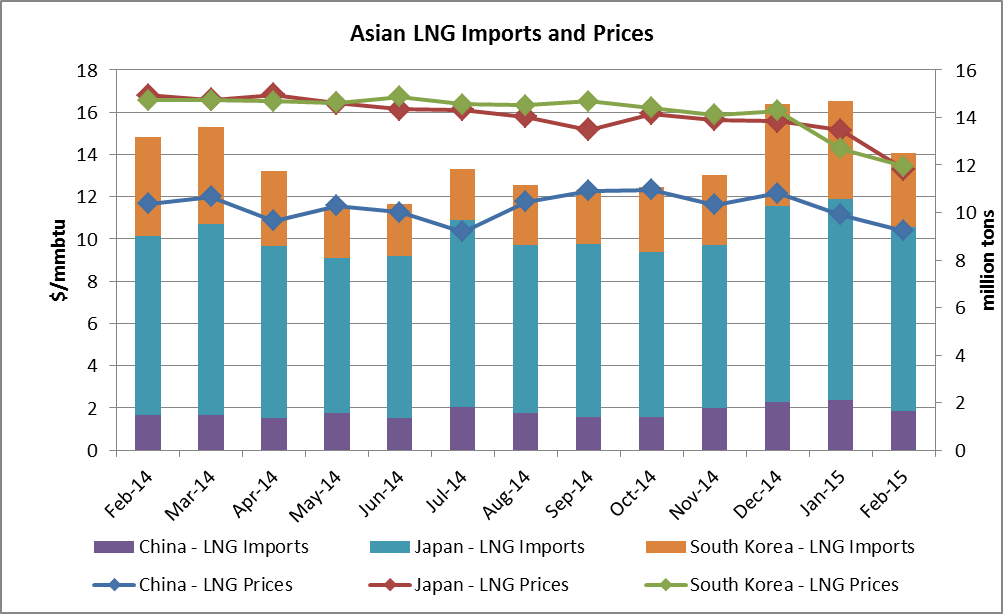

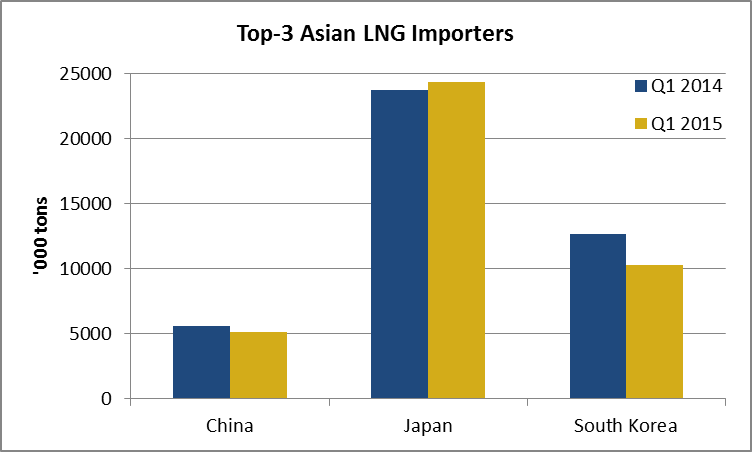

In Asia, LNG purchases of the regional top-3 buyers (Japan, South Korea and China) decreased by 5.5% year-on-year in the first quarter of 2015. Imports fell from 42 million tons to 39.7 million tons, pulled by a 19% drop in South Korea (-2.4 million tons) where higher inventories and another mild winter pushed imports down. Lower demand for natural gas was highlighted by the drop in KOGAS’ domestic sales (-7.6%), mainly due to a fall in sales to the power sector (-14.3%).

In Asia, LNG purchases of the regional top-3 buyers (Japan, South Korea and China) decreased by 5.5% year-on-year in the first quarter of 2015. Imports fell from 42 million tons to 39.7 million tons, pulled by a 19% drop in South Korea (-2.4 million tons) where higher inventories and another mild winter pushed imports down. Lower demand for natural gas was highlighted by the drop in KOGAS’ domestic sales (-7.6%), mainly due to a fall in sales to the power sector (-14.3%).

In China, imports declined by 8.6% from 5.6 million tons to 5.1 million tons while in Japan, LNG purchases grew slightly from 23.7 million tons in Q1 2014 to 24.3 million tons in Q1 2015, even though mild temperatures cut total power demand.