In 2014, the purchase of Repsol’s LNG assets in Peru and Trinidad and Tobago brought Shell an additional 4.3 mmtpa in liquefaction capacity and strengthened its global leadership in the LNG upstream sector. With the $70 billion takeover of BG, the Anglo-Dutch major is about to become the unquestionable leader, thanks to the world’s largest and most diverse portfolio. BG’s contracts will provide the company with an unprecedented coverage of global markets, but Shell has to keep developing LNG projects, as the medium- and long-term production of BG’s assets is uncertain.

Blog - Page 43

Russian Gas Market: Entering New Era

After a period of extensive growth in the 2000s, the Russian gas industry is now facing numerous challenges. Mounting competition by independent producers and the development of new production by Gazprom, combined with stagnating domestic demand and weakening export markets, have created a situation of overproduction, made worse by western sanctions and low oil and gas prices. Expansion to the East thanks to the recent China deal is not expected to provide much relief before 2024. The coming decade will be critical for the industry and its outcome will largely depend on the government’s pricing and institutional policies but the role of the state should remain essential.

The New CEDIGAZ report “Russian Gas Market: Entering New Era” by Tatiana Mitrova (Russian Academy of Sciences) and Gergely Molnar analyses the ongoing changes in the Russian industry and the challenges to be met.

International Gas Prices – April 3 , 2015

NBP: Long-term and spot prices converging in 2015?

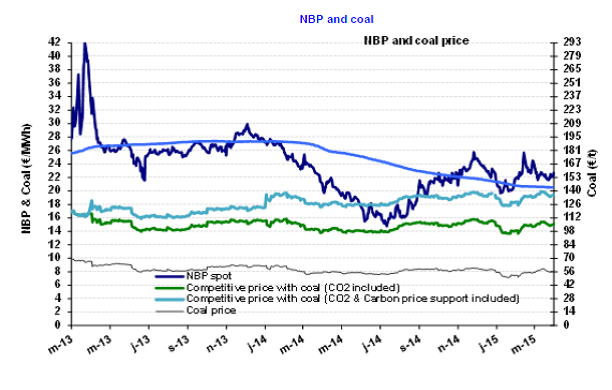

The NBP price averaged €22.3 /MWh ($7.1/MBtu) in March, down 4.5% over February. The average for winter 2014-15 was roughly the same (€22.5/MWh), lower by 16% than that of the previous winter. So concerns over supply (Russia versus Ukraine, uncertainty over Groningue, the storage capacity at Rought) have not had a structural effect on prices.

The NBP price averaged €22.3 /MWh ($7.1/MBtu) in March, down 4.5% over February. The average for winter 2014-15 was roughly the same (€22.5/MWh), lower by 16% than that of the previous winter. So concerns over supply (Russia versus Ukraine, uncertainty over Groningue, the storage capacity at Rought) have not had a structural effect on prices.

In upcoming months, the market is anticipating an average price of €21.5/MWh ($6.7/MBtu) for next summer and €24/MWh ($7.6/MBtu) for next winter. Based on the current forecasts, these levels are moving towards convergence with the prices of oil-indexed contracts. If the trend persists and convergence occurs, this would represent a break with the situation observed since 2009. Between 2009 and 2014, the indexed prices served as a ceiling for the NBP, whose prices were systematically lower.