GLOBAL OVERVIEW

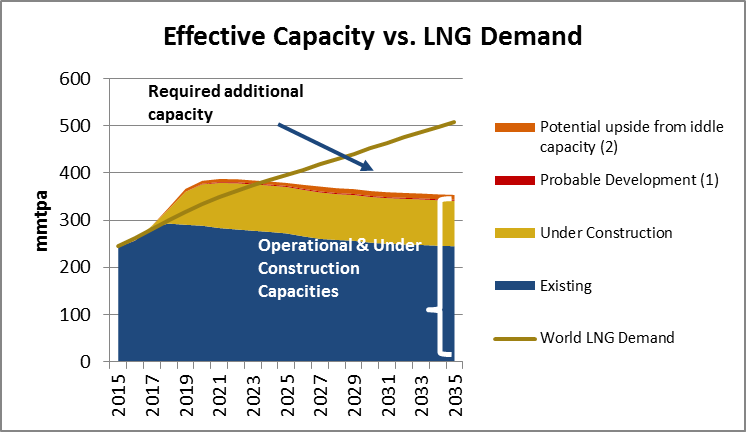

- Total effective capacity[1] is expected to increase significantly from 244 mmtpa in 2015 to 387 mmtpa in 2021 (+60%). Subsequently, effective capacity from facilities currently operational or under-construction should progressively decrease to reach 354 mmtpa by 2035 due to the aging of some assets and gas shortages in some producing countries. Demand will struggle to keep up with supply ramp-up at the beginning of the projection period and an over-supply situation should prevail. Rebalancing of the market is not expected before 2023, or even 2024 if probable developments (Fortuna FLNG) and potential upside from currently idle capacity (Egypt, Yemen) are taken into account. After that, the continuous growth of the LNG market will leave a large margin for the implementation of new projects.

Effective Capacity vs LNG demand

(1): Equatorial Guine (2): Egypt, Yemen

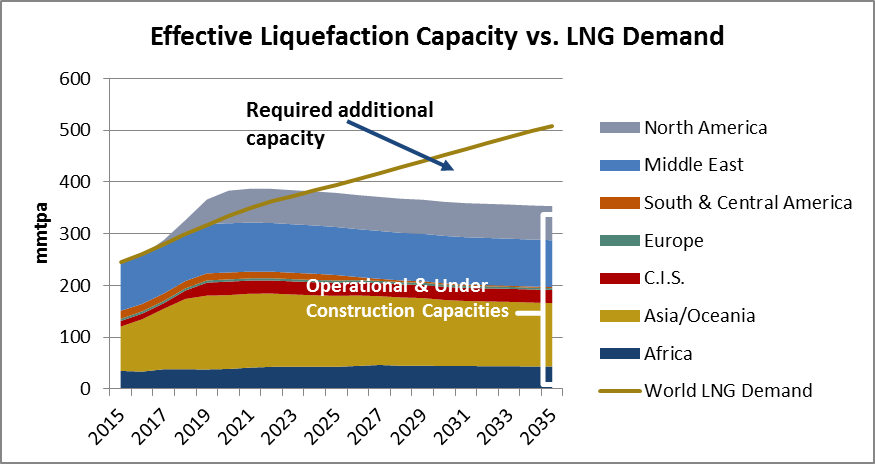

- Three main regions stand out: Asia-Oceania, the Middle East and North America. Effective liquefaction capacity in Asia-Oceania is expected to see a significant increase reaching a plateau between 2019 and 2023 and then decreasing until 2035. Capacity in the Middle East remains broadly stable throughout the period with just over 90 mmtpa of effective liquefaction capacity, although Qatar’s recent announcement calling for a 30% production growth to 2024 could change the game. In North America the stepping up of United States’ LNG will constitute a major upheaval, with a total liquefaction capacity expected to reach 66 mmtpa by 2021 (Canada included).

- LNG capacity in Africa and the CIS should remain stable after a slight increase at the beginning of the projection period. Stability is also expected in Europe, while effective capacity will gradually decrease in South & Central America due to growing constraints on feedstock as Trinidad and Tobago’s gas reserves dwindle.

Effective liquefaction Capacity vs LNG demand by region